Did Liberty First Lending send you a mailer that claims to prequalify you for a loan of up $24,000 with a 5.99% interest rate (similar to the one below)? They suggest that this loan will allow you to receive funds in 1-2 business days, help you reduce your monthly payment, and save you thousands of dollars.

Have you applied?

My name is Ben, and I have spent the last five years helping people understand the differences in options to help them eliminate debt cheaper, easier, and faster. I have also uncovered debt consolidation scams. I was also one of the first to write an article covering the unfortunate Litigation Practice Group bankruptcy and have spoken with countless people negatively affected by it. I created “Your Debt Relief Pal” to help protect you from any debt company that may have deceptive marketing and provide you with realistic estimates of your options for debt freedom.

So, what is Liberty First Lending?

What is Liberty First Lending?

After doing some research online, we’ve discovered that Liberty First Lending markets themselves as a debt consolidation loan company that offers “Loans designed to help you pay off your credit cards and simplify your life”. A surprising fact we learned that they operate a whopping four websites: libertyfirstlending.com, lib1st.com, liberty1stloan.com, and libertyfirstlending.squarespace.com. The first three websites were created quite recently, with their respective registration dates being as follows: 2/21/2023, 8/16/2023, 8/23/2023 (we were not able to get the last website’s registration date because it was created through squarespace.com).

The fine text at the bottom of the libertyfirstlending.squarespace.com website states: “Liberty First Lending’s lending partners offer fixed rates between 10.50% APR and 29.99% APR for loan amounts from $5,000 to $40,000. The minimum rate for loan amounts above $15,000 is 10.99% APR. The minimum loan amount and APR may vary in certain states.”

Immediately, we can see that First Liberty Lending mailers have a discrepancy with what is advertised on their website. The mailers mention a 5.99% APR (although writing in tiny print “Example for illustrative purposes only”), which is much less than what is written on their website.

The mailers also claim that the recipient has been “PRE-APPROVED for a Consolidation Loan” which, once again, conflicts with what is written on their website. They state: “Eligibility for a loan is not guaranteed. We may be unable to provide you with a loan, if, after you respond to this offer, we determine that you do not meet the criteria established for this offer.” Unless you take the effort to read the small print, it is highly likely you will gloss over these details and believe you are pre-approved for a debt consolidation loan when, in fact, you are not.

Check Your Loan Rate and Compare Options!

You may be looking for a debt consolidation loan, but do you qualify? Is your credit score good enough? Is your debt-to-income ratio or credit utilization good enough? I helped build this free consolidation loan and other options calculator to help you compare your rates across multiple debt consolidation lenders and your options to other options if you cannot qualify for a loan. It’s specific to your financial information, so if you have $10,000 in debt, it will provide an estimate of your situation.

You can then check your rate, which will NOT affect your credit score.

Did you receive a debt consolidation “program” quote?

Has a sales representative provided you with a quote that may look something like the quote below?

- $X Amount Per Bi-weekly or Month

- Y # of Months

- A legal plan to protect against lawsuit

- Your fee is already “included in your monthly payment”.

If so, WHAT IS THE ACTUAL FEE?

You may want to take this free debt consolidation program fee estimator to see your charges.

It takes 30 seconds and does not require ANY personal information.

Liberty First Credit Score Requirements

Another aspect we’d like to highlight are credit score requirements. As previously mentioned, due to the wording on the mailer, it is presumed that the recipient has been pre-approved for the debt consolidation loan. However, Liberty First Lending’s website actually states that: “All loans are subject to credit review and approval. Your actual rate depends upon credit score, loan amount, loan term, credit usage, credit history, and state of residence.”

They also mention that the recipient of the mailer has received it because they have met “criteria related to creditworthiness”, yet they fail to disclose what exactly those criteria are. This could be misleading as it implies the person has a credit rating strong enough to qualify for the loan. Lastly, the company mentions that if you agree with the interest rate they provide you, “a hard inquiry will be run prior to funding that could affect your credit score.” All these factors are important to keep in consideration when working with Liberty First Lending, as assuming you are pre-approved could misinform your decision.

Liberty First Lending Reviews

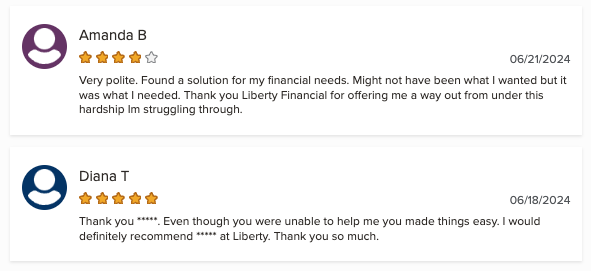

Now that you understand Liberty First Lending’s history and what it does, we’d like to dive into the company’s reviews. Hopefully, this will allow you to better understand what other people have experienced and what you might expect when working with Liberty First Lending.

BBB

The site we checked was the Better Business Bureau (BBB). This accredited non-profit organization provides the public with information on businesses and charities. After searching up Liberty First Lending, we found that the company is rated 2.4/5 stars, has 3 complaints closed in the last 3 years, and 3 complains closed in the last 12 months.

Positive Reviews

Negative Reviews

The reviews we highlighted seem to claim to have a general consensus that the company tends to pre-approve people for debt consolidation loans despite that not being the case. Several individuals mention that the company then tries to “enroll people in a debt relief program” (aka. debt settlement / debt consolidation). Others mention that when they brought up the mailer, Liberty First Lending did not recognize the promotion and said they had “no idea what it was”. This could imply that the company engages in bait and switch tactics, informing customers that they are not eligible for the debt consolidation loan to push them into a debt settlement program.

Important Distinction: Debt Consolidation Loans vs Debt Consolidation Programs

Now that we’ve brought to light Liberty First Lending’s possible functions as a marketing agent to debt settlement companies, we’d like to explain the differences between debt consolidation loans and debt consolidation programs (aka. debt consolidation / debt relief). In short, there is a huge difference between the two, and it’s important not to get them mixed up.

Debt consolidation loans are loans you receive (typically with a lower interest rate than the rest of your outstanding debts) to consolidate your debts and pay them off faster. With debt consolidation programs, you allow your debts to fall behind so that a debt consolidation company can settle your debts for ~50% of their value. Debt consolidation companies also typically take a fee of ~25% of your debt’s value. With debt consolidation, it is possible that there might be hidden origination fees, balance transfer fees, closing costs, and annual fees. Furthermore, even though your monthly payment might be lower, the interest will likely accrue over a longer period of time, causing you to pay a higher amount of interest over the life of the loan.

Therefore, it is crucial to compare different debt consolidation programs and be aware of any hidden costs or fees. If you are looking for a loan, however, we have 2 debt consolidation loan options that do not affect your credit score when checking rate and do not charge prepayment penalties.

How Much Do Debt Consolidation Programs Cost?

At Ascend, we believe that debt consolidation programs (debt relief) may be a good option, but often in context in understanding all the costs and duration estimates of all your options. As such we built the free debt consolidation program cost calculator below to help you compare your current monthly obligations to a debt consolidation program.

Generally programs cost between 15-25% of your enrolled debt amount.

Alternative Options to Liberty First Lending

Many people prefer to try to get a debt consolidation loan before looking at options such as debt management, debt payoff planning, debt settlement or bankruptcy. If you’ve searched far and wide for a loan and can qualify, consider taking the free debt consolidation program cost calculator below that allows you to compare to other options.

Closing Thoughts

From my research, although not definitive or exhaustive by any means, we can reasonably conclude that Liberty First Lending offers debt consolidation loans while also being a marketing service that refers their clients to debt settlement companies.

Now that you have other information about the company’s history and its online reviews, it’s important to remain aware about the company’s alternative motives and marketing tactics, as well as how that fits with your personal financial situation. As always, it’s a good practice to do your own research and build your own opinion.

Leave a Reply