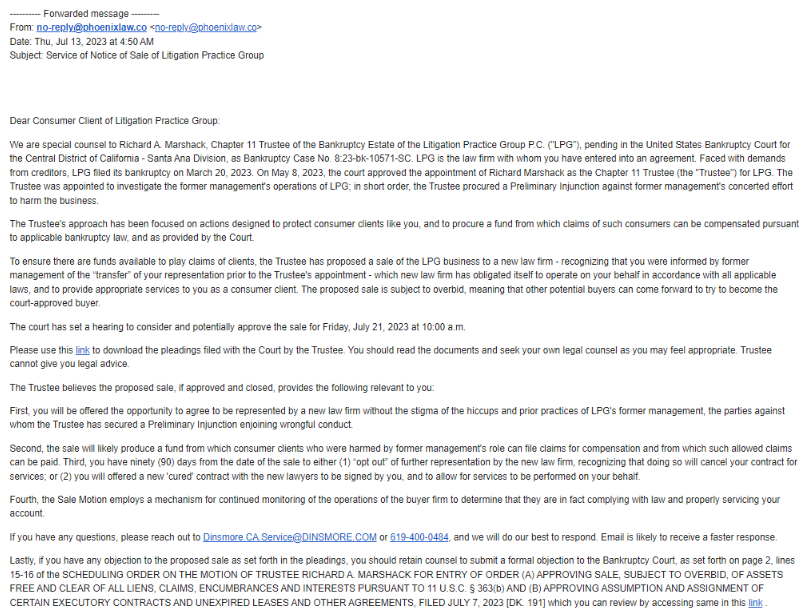

7/13/2013 Update: We received notification that the special counsel to the Chapter 11 trustee has ordered a sale of Litigation Practice Group. Did you receive an email such as the one below?

6/6/2023 Update: We corresponded with an individual who stated that they received the following text message, “Hello, I am an ex LPG employee. I saw your number on the comment section of an article about LPG. LPG sold your account to Phoenix law. Phoenix Law is actually same as LPG, same head attorney and owner. The attorney is barred from practicing. Phoenix Law is a Trojan horse company stealing people’s hard earned money. I found out all this after I was fired from LPG and they filed BK. LPG and Phoenix Law and Oakstone law are all going through an investigation as we speak. Call Phoenix law 424-622-4044 and demand to speak to Ty Carrs and demand your money back. These are not good people. Their office is being investigated by the BK trustee. It’s on the news. They scam elderly as a form of debt resolution. It’s all BS. Send me a confirmation that you got this but please don’t expect a reply. My job is to spread the news because yall deserve it to know. God bless and good luck.”

May 3, 2023 Update: 1) We have heard a report that an individual has been charged with two different charge descriptions: Legal 1 Services and Monthly Legal Service.

May 1, 2023 Update: We have heard reports that some people who have been transferred may have been double charged with charge descriptions of Touzi Capital and Guardian Processing.

You may have joined Litigation Practice Group / Gallant Law Group / Valiant Law Group for debt validation or debt relief and received an email about getting transferred to Consumer Legal Group, Phoenix Law (with a mailer similar to the one below), Oakstone Law Group, Greyson Law, or Gallant Law PC. We are first going to cover the following before getting into the details about Litigation Practice Group:

What is Going On with Litigation Practice Group?

What Are the Companies LPG is Transferring You To?

Is Litigation Practice Group still in Business?

Can You Get A Refund?

Will Phoenix Law or Oakstone Process a Refund?

What Can You Do With Your Negatively Affected Credit Score And With The Debt?

Now that you understand more about the company and alternatives., let’s look at the Litigation Practice Group reviews.

What is a Litigation Practice Group?

You may have come through to Litigation Practice Group (ie. LPG Law) from Debt Advisors of America or from a Google search. What is Litigation Practice Group? What are the reviews?

We will address these questions and more, so let’s get started.

Are you willing to share about your experience with the Litigation Practice Group? If so, we would love to hear from you. Please fill out this form to learn more.

According to BBB, Litigation services provide a variety of legal services to debtors to help address their debt, including validation of debts, bankruptcy and debt defense.It appears one of the things Litigation Practice Group does is debt relief, also known as debt settlement or debt consolidation.

Debt relief may be a good option if you face financial hardship as you can save money because the firm will try to settle the debts for potentially 50% of what is owed.

The challenge is that the company settles your debts one by one when the accounts fall behind. As your accounts fall behind, your credit score may be negatively affected and you may face debt collection lawsuits. Did Debt Advisors of America or Litigation Practice Group share the cons of debt relief?

LPG Law Lawsuit:

When researching Litigation Practice Group, you may have also seen the potential Litigation Practice Group class action lawsuit filed in March 2022.

In the lawsuit, the plaintiff alleges violations of the Georgia debt adjustment act and the credit repair organizations act. In the lawsuit, the plaintiff argues that LPG Law paid itself for services not yet rendered, arguing that LPG violated the CROA.

Furthermore, the lawsuit alleges that the fee obtained by LPG was in excess of the 7.5% fee permitted in Georgia.

On page 7, LPG denied the allegations and filed a notice of removal.

Let’s look at alternatives to Litigation Practice Group.

Litigation Practice Group Reviews

In this section, we will cover the BBB reviews, Google reviews, Yelp reviews, Indeed reviews and Glassdoor reviews.

BBB Reviews

Litigation Practice Group has a 3.01 based on 391 customer reviews, but it has 438 complaints in 3 years with 86.5% (379 complaints) of the complaints happening in the last 12 months.

With 379 complaints in the last 12 months, I thought it would be interesting to jump into the complaints to see what individuals were complaining about.

BBB Complaints

One reviewer stated that he/she was in the program for 2 months and argues that his/her credit score had fallen and that he/she called for a refund, but none was given. The individual stated that another payment was then taken. Based on updated made with debt relief companies, a debt relief firm generally only should take its fees after a settlement has been made.

This complaint alleges that the couple thought they were applying for a debt consolidation loan, but only qualified for this program. The individual stated that they signed up, but then realized that there were 36 pages of BBB complaints, so they attempted to cancel the program. The couple stated that the company still tried to take the funds from their bank account, but the couple stated they were smart and closed the bank account.

Now, let’s take a look at the Google reviews.

Google Reviews

At the time of this writing, Litigation Practice Group maintains a 3.7 based on 368 reviews.

When reviewing reviews, you may want to see: 1) The most recent reviews as it provides a look at individuals recent experience 2) The lowest reviews to see if anyone had a negative experience.

With Litigation Group, here were the most recent reviews at the time of this writing. One individual alleges that the company took over $15,000 from them. The other individual alleges that there is no one able to speak with them, and that the representative would let someone know, but the reviewer stated that no one gets back to them.

Not all of the reviews are negative though. A positive LPG review stated that the individual has been with the company for 2 years and is almost debt free.

Let’s consider potential employee reviews of LPG law.

LPG Law Employee Reviews

Both Indeed and Glassdoor both provide opportunities to employees to review their company. This may provide an inside look of how Litigation Practice Group employees appreciate the job, but it cannot be confirmed that these are actually employees, so take it for what it is.

For these reviews, Litigation Practice Group has a 1.9 based on 8 Indeed reviews

In addition, LPG Law has had a 2.1 based on 6 Glassdoor reviews at the time of this writing.

Conclusion

If you are currently enrolled with Litigation Practice Group, hopefully this article helps you understand the reviews and how the company works.

You may have a few options if any of these apply to you:

- Choose which debts to pay each month.

- Live check to check with an increasing debt balance each month.

- Experienced financial hardship

For example, you may qualify for nonprofit credit counseling or another less expensive debt relief program or debt payoff planning or bankruptcy.

Leave a Reply