My name is Ben, and I have spent the last 5 years helping people understand the differences in options to help them eliminate debt cheaper, easier, and faster. I have uncovered debt consolidation scams. I was also one of the first to write an article covering the unfortunate Litigation Practice Group bankruptcy have spoken with countless people negatively affected by it.

I created “Your Debt Relief Pal” to help protect you from debt companies that may use deceptive marketing and provide you with realistic estimates of your options for debt freedom.

What in the world?

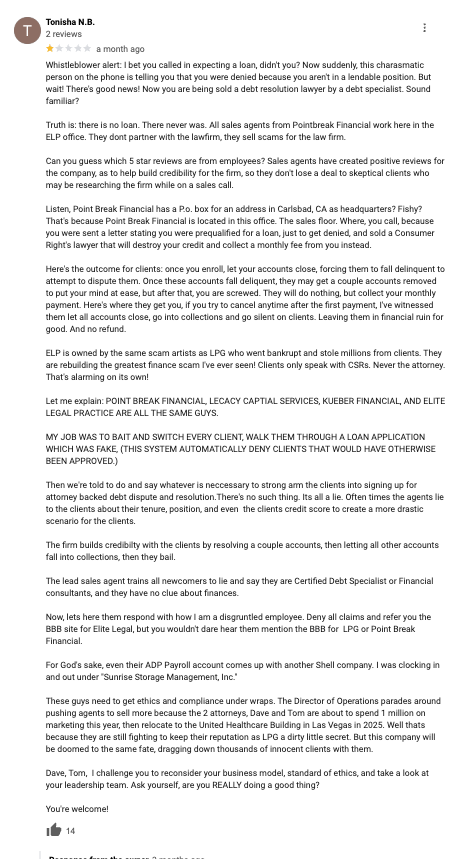

I will cover more ELP reviews later, but I found an interesting Google review. This essentially talks about how this company allegedly works.

I found the company’s response equally intriguing.

The company’s team states that she was let go and was a former employee and that the company is bar-certified and BBB-accredited. My question to the owners though is, “why would Tonisha share this information if it were not true?”

And, do you have proof that anyone gets a loan from the Point Break Financial letters? If so, what percentage gets a loan and what percentage gets recommended to your debt validation program?

Check Your Rate and Compare Options!

You may be looking for a debt consolidation loan, but do you qualify? Is your credit score good enough? Is your debt-to-income ratio or credit utilization good enough?

I helped build this free consolidation loan and other options calculator to help you compare your rates across multiple debt consolidation lenders and your options to other options if you cannot qualify for a loan. It’s specific to your financial information, so if you have $10,000 in debt, it will provide an estimate of your situation.

You can then check your rate, which will NOT affect your credit score.

If you do check your rate, understand the interest rate and the origination fee to see how much you will save by consolidating your debt. The above options do not charge prepayment penalties and have fixed rates, but if you use a different lender, these are important characteristics to look for.

What is Elite Legal Practice?

What Does Elite Legal Debt Resolution Program Mean?

One of the most helpful things to understand is that debt validation or debt collection mitigation is not debt settlement. For example, in debt validation, you are NOT putting money towards settling the debt, which is often why debt validation quotes are so much less than debt settlement quotes. We actually just published a video on YouTube covering “Don’t Do Debt Validation Before...” covering the differences between debt validation and debt settlement, but it’s important to understand the differences because you could get an estimate of $400 per month from a debt validation company, but $800 per month from a debt settlement company.

Understand the Reviews

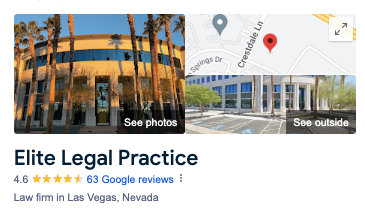

Per BBB, Elite Legal Practice has an A- rating and 6 complaints in the past year.

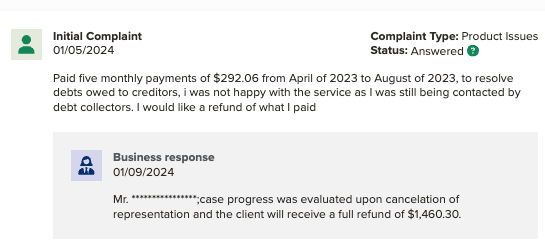

Please note some of the complaints I found interesting.

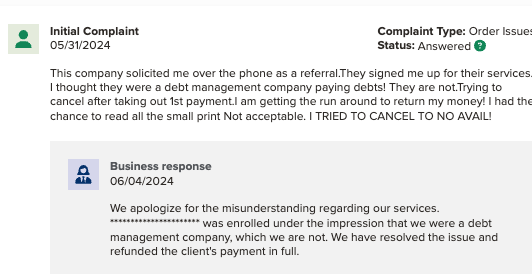

First, this individual stated that he thought that Elite Legal Practice was a debt management company, and had a difficult time canceling.

This individual appeared to be able to get a refund after complaining to BBB.

Understand Your Options

You may wish to continue with Elite Legal Practice, but it may be helpful to understand a breakdown of all the services that you are paying for.

Also, check out a debt validation article showing how debt validation works.

Leave a Reply