This article is written for informational purposes and should not be construed as legal or financial advice.

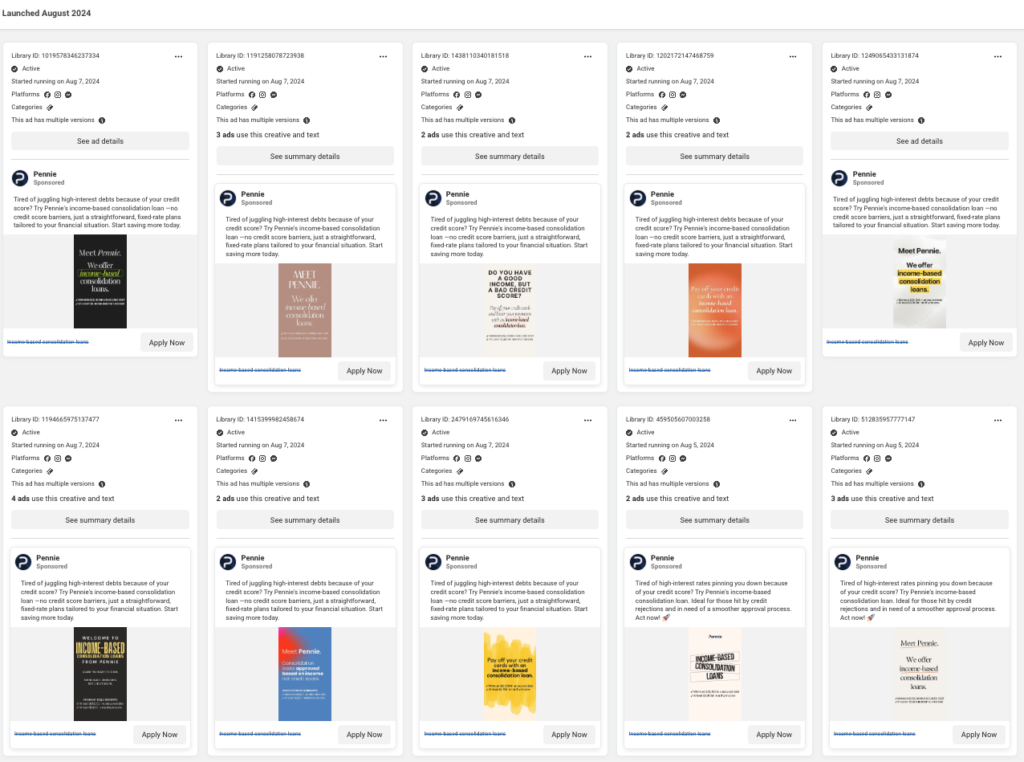

Have you seen any Try Pennie social media ads below, pitching an income-based consolidation loan (source)? Does it say that there are no credit score barriers?

Sounds great, right?

My name is Ben, and I have spent the last five years helping people understand the differences in options to help them eliminate debt cheaper, easier, and faster. I have also uncovered debt consolidation scams and was one of the first to cover the unfortunate Litigation Practice Group bankruptcy. I created “Your Debt Relief Pal” to help protect you from debt companies that may use deceptive marketing and provide you with realistic estimates of your options for debt freedom.

So, what is Try Pennie? Should you work with them? How do their rates compare to other companies? What do reviews online say about them? We will cover all of that and more in this article.

What Is Try Pennie?

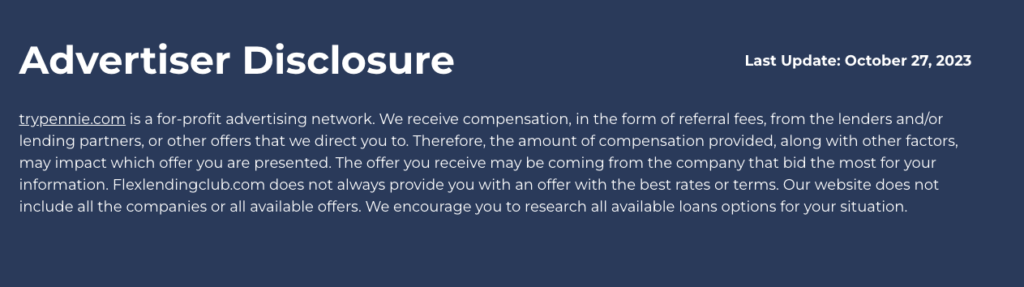

I read through many of the Try Pennie terms, and what I found interesting was a link in another website called flexlendingclub.com. I looked up that website and could find nothing about that entity. What’s interesting is that it’s not nearing the end of 2024 and the company still has not updated it.

Source: trypennie.com

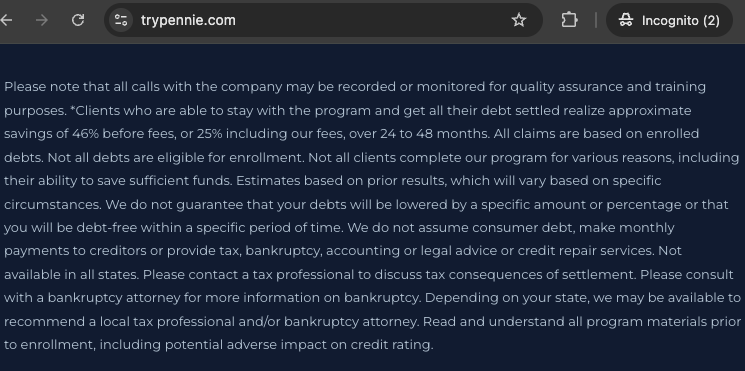

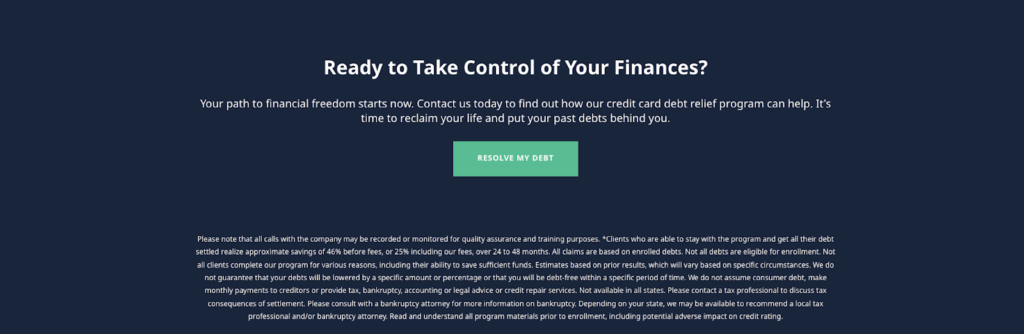

Next, I noticed in the footer that Try Pennie writes information that clients who stay in the “program” and can settle their debts realize an approximate savings of 46% before fees or 25% including fees.That is NOT what I see when looking at debt consolidation loan providers. Debt consolidation loan providers often state an interest rate, NOT a settlement fee range.

It is unclear if Try Pennie advertises for debt consolidation loans or programs. Please note that another name for a debt consolidation program is debt relief. There is a vast difference between debt consolidation programs and debt consolidation loans. The most significant difference between loans and programs is that with debt consolidation loans, you get money in your bank accounts to pay off debt. With debt consolidation programs, your accounts go behind, and the company settles your debt. Your credit score is hurt, and you could be sued for your unpaid debt. It could be a good option for you, but it’s important to understand the pros and cons.

Finally, I could not find much more information on Try Pennie’s “About Us” page regarding the Try Pennie CEO/executives, nor could I find more information about the address where Try Pennie is located, but just that the company is located in Miami, Florida.

Is Try Pennie Related to National Debt Relief?

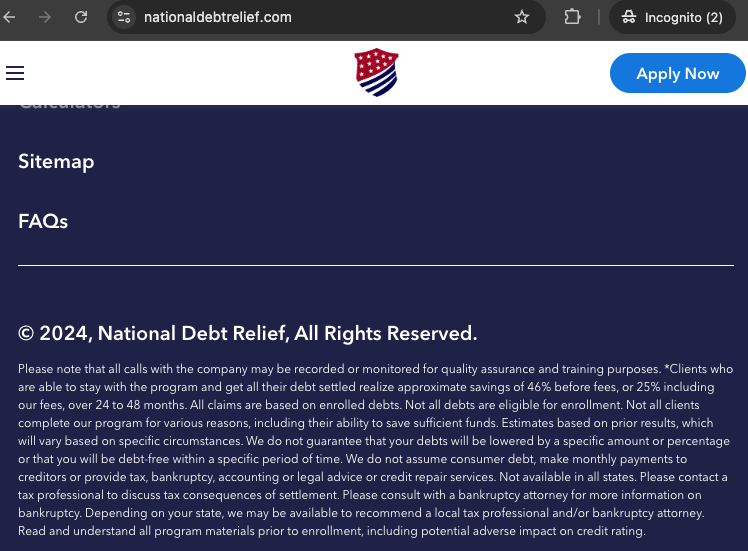

In my recent research, I noticed that Try Pennie Loans has a debt settlement page that appears to have the exact same text as National Debt Relief’s disclaimer. I ran it through this diff checker, and found no difference.

Here’s Try Pennie Disclaimer disclaimer language:

Source: trypennie.com

Here’s National Debt Relief’s disclaimer language:

Source: nationaldebtrelief.com

Check Your Loan Rate and Compare Options!

You may be looking for a debt consolidation loan, but do you qualify? Is your credit score good enough? Is your debt-to-income ratio or credit utilization good enough? I helped build this free consolidation loan and other options calculator to help you compare your rates across multiple debt consolidation lenders and your options to other options if you cannot qualify for a loan. It’s specific to your financial information, so if you have $10,000 in debt, it will estimate your situation.

You can then check your rate, which will NOT affect your credit score.

If you do check your rate, understand the interest rate and the origination fee to see how much you will save by consolidating your debt. The above options do not charge prepayment penalties and have fixed rates, but if you use a different lender, these are important characteristics to look for.

Did you receive a debt consolidation “program” quote?

Have you spoken to a representative who mentioned a loan, a program, and a hybrid option? If so, your quote may looks something like this:

- $X Amount Per Bi-weekly or Month

- Y # of Months

- You may get pitched on a legal plan to protect against lawsuit

- You may have no idea what percentage fee you are actually being charged.

When you get a debt consolidation program quote, you may just hear that your quote includes the monthly fee, but it’s crucial to understand what FEE you’re being charged.

As such, you may want to take this free debt consolidation program fee estimator to see what you may be being charged.

It takes 30 seconds and does not require ANY personal information.

Let’s next look at Pennie loan reviews.

Pennie Loans Reviews

When I review a company, I like to look at BBB reviews and complaints, Google reviews, and TrustPilot reviews.

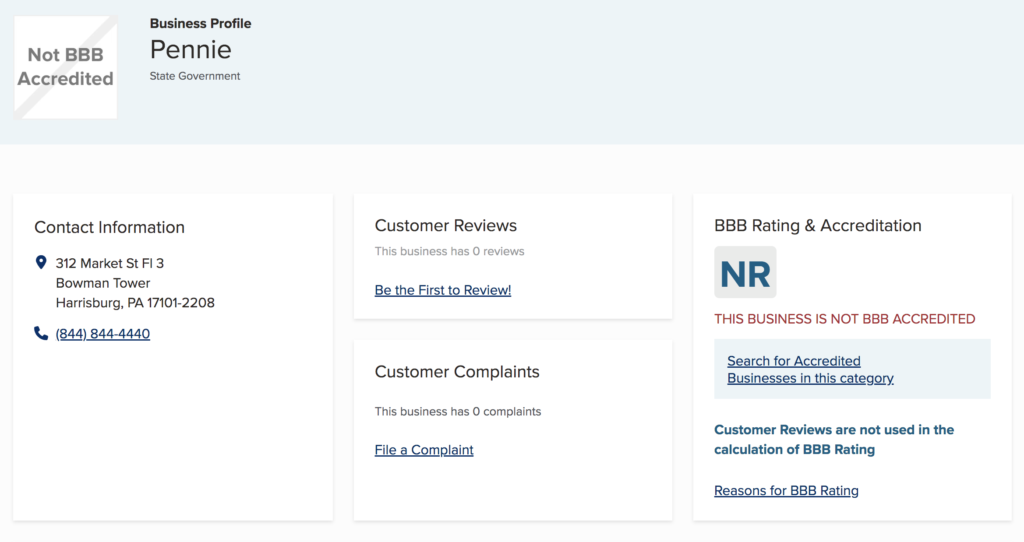

BBB

Unfortunately, I was unable to find TryPennie on BBB.

I found Pennie on BBB, but I was not 100% sure if they were the same company because it said state government.

TrustPilot

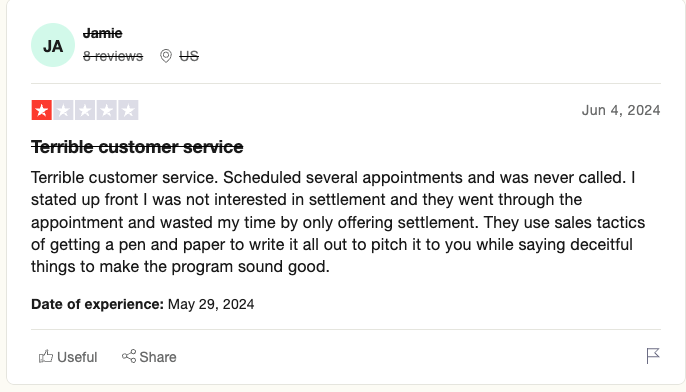

Recently, I found one more review for Try Pennie from TrustPilot. Here’s the review:

This reviewer mentioned that she was not interested in debt settlement.

She alleges that they use sales tactics with pen and paper to write out everything to pitch you why a debt settlement program is good.

Other Reviews

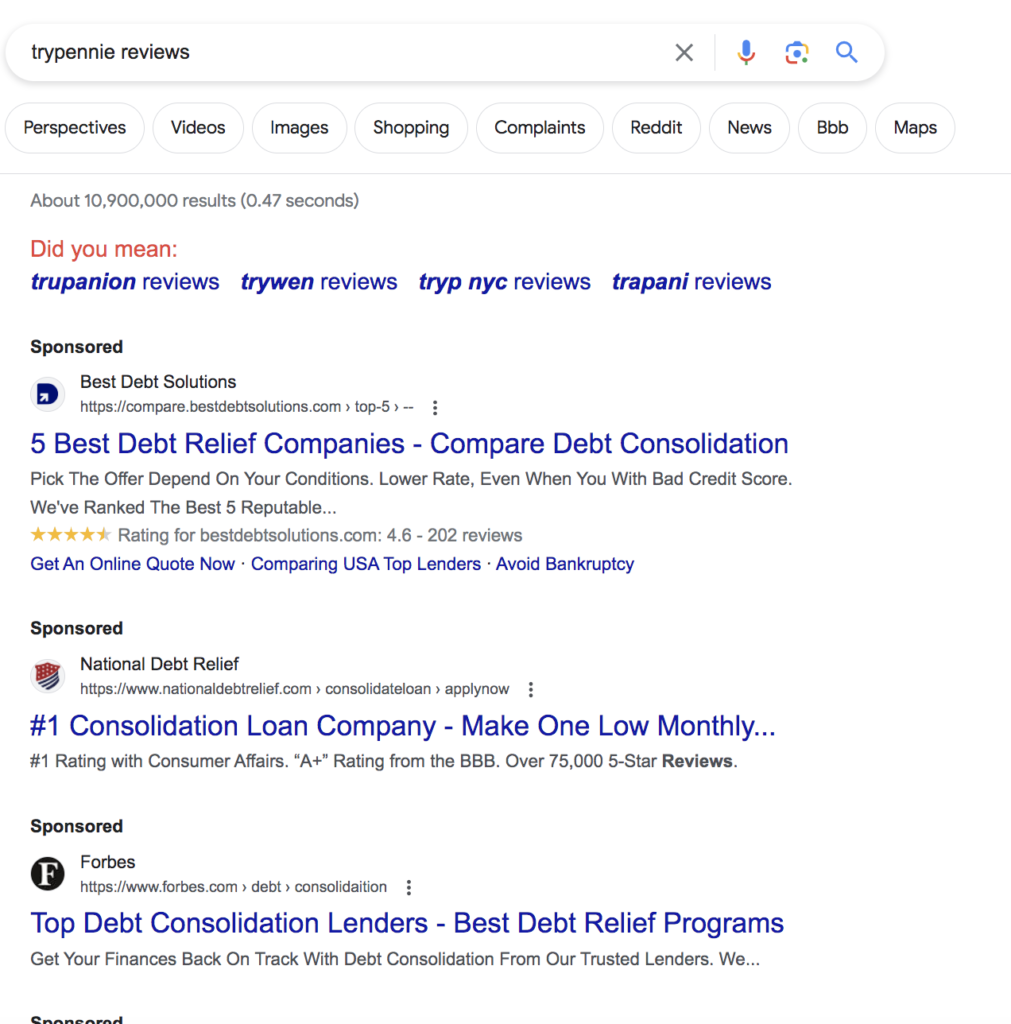

Unfortunately, I was unable to find TryPennie on any other review websites. It makes me wonder if TryPennie is a newer company and if people haven’t had the chance to experience how it operates yet.

I found a couple of reddit posts here and here referring to Try Pennie, but the articles didn’t have any actual customer reviews.

It just provided questions about whether people have used Try Pennie.

How Much Does TryPennie Loans Cost In Fees?

It has been challenging to find a ton of information on TryPennie; however, I did notice at the bottom of their website, in fine print, they had this disclaimer:

As I stated above, The disclaimer at the bottom stuck out to me, “Clients who can stay with the program and get all their debt settled realize approximate savings of 46% before fees, or 25% including our fees, over 24 to 48 months.” This means they will negotiate with your creditors to get your debt amount down to about 46%, which is around the average for a debt settlement company. But then, they mention that you will save only about 25% after fees, which is vastly different.

What are Alternatives to TryPennie?

An alternative to TryPennie would be debt management, debt payoff planning, a debt consolidation loan, debt settlement, or bankruptcy.

The free debt options calculator above can go through the costs of each option.

Conclusion

From my research, I realize I am unsure how Try Pennie operates.

One question I have is whether Try Pennie negotiates with creditors and why they charge a lot for their services. I am still unsure if they are a legitimate company, and I find it interesting that they have zero reviews now.

It is essential to do all your research before working with a company. Reading other reviews and learning from their experiences is a great way to see if a company would suit you well. Because they currently have no reviews, I am unsure if they are legitimate.

Leave a Reply