This article is for informational purposes only and should not be construed as legal or financial advice.

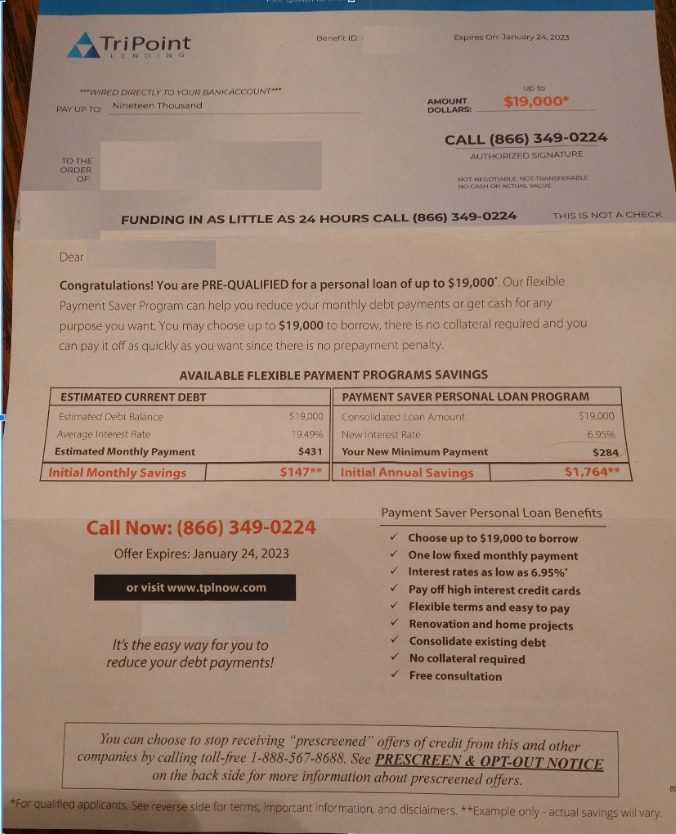

Did you receive a mailer from TriPoint Lending (like the one below) pre-qualifying you for a debt consolidation loan for as low as 6.95%?

We will cover the answers to this question and more in this article.

My name is Ben, and I have spent the last 5 years helping people understand the differences in options to help them eliminate debt cheaper, easier, and faster. I have uncovered debt consolidation scams. I was also one of the first to write an article covering the unfortunate Litigation Practice Group bankruptcy have spoken with countless people negatively affected by it.

I created “Your Debt Relief Pal” to help protect you from any debt company that may have deceptive marketing and provide you with realistic estimates of your options for debt freedom.

1. What Is TriPoint Lending?

I became aware of TriPoint Lending from a call with a person I will name John. John was struggling to make ends meet and had a high debt-to-income ratio, so I was somewhat surprised that he would be getting debt consolidation loan offers. My initial hypothesis is that TriPoint Lending is a marketing company that markets debt settlement (also known as debt consolidation programs). This is not to be mistaken or confused with a debt consolidation loan, where proceeds would be sent to your bank account.

Important Distinction: Loans vs Programs

Debt consolidation loans are a great option if you are looking to keep your account open. You have an interest rate connected to the loan and it will put funds in your account. You may be able to see your credit score improve with this option and there is no real threat of getting sued by your creditors.

Debt consolidation programs or also known as Debt settlement are a great option if you are behind on your accounts and do not see yourself being able to catch up any time soon. You may be in a place where you need help lowering the total debt amount you owe. That is when a program can be helpful. The company would go in and negotiate with your creditors to lower your total debt amount down to ~50% of what you owe. There is a threat of creditors suing and your credit score can take a hit with this option.

Now, if you are looking for a debt consolidation loan, there are three debt consolidation loan companies that we have vetted: 1) Only do a soft check to check your credit, and 2) Do not charge prepayment penalties. With debt consolidation loans, checking your rate from multiple places may be helpful to get the best rate. If you can’t qualify, then some individuals look at debt settlement.

Did you receive a debt consolidation “program” quote?

Have you spoken to a representative who mentioned a loan, a program, and a hybrid option? If so, your quote may looks something like this:

- $X Amount Per Bi-weekly or Month

- Y # of Months

- You may get pitched on a legal plan to protect against lawsuit

- You may have no idea what percentage fee you are actually being charged.

When you get a debt consolidation program quote, you may just hear that your quote includes the monthly fee, but it’s crucial to understand what FEE you’re being charged.

As such, you may want to take this free debt consolidation program fee estimator to see what you may be being charged.

It takes 30 seconds and does not require ANY personal information.

Check Your Loan Rate and Compare Options!

You may be looking for a debt consolidation loan, but do you qualify? Is your credit score good enough? Is your debt-to-income ratio or credit utilization good enough?

I helped build this free consolidation loan and other options calculator to help you compare your rates across multiple debt consolidation lenders and your options to other options if you cannot qualify for a loan. It’s specific to your financial information, so if you have $10,000 in debt, it will provide an estimate of your situation.

You can then check your rate, which will NOT affect your credit score.

TriPoint Lending History

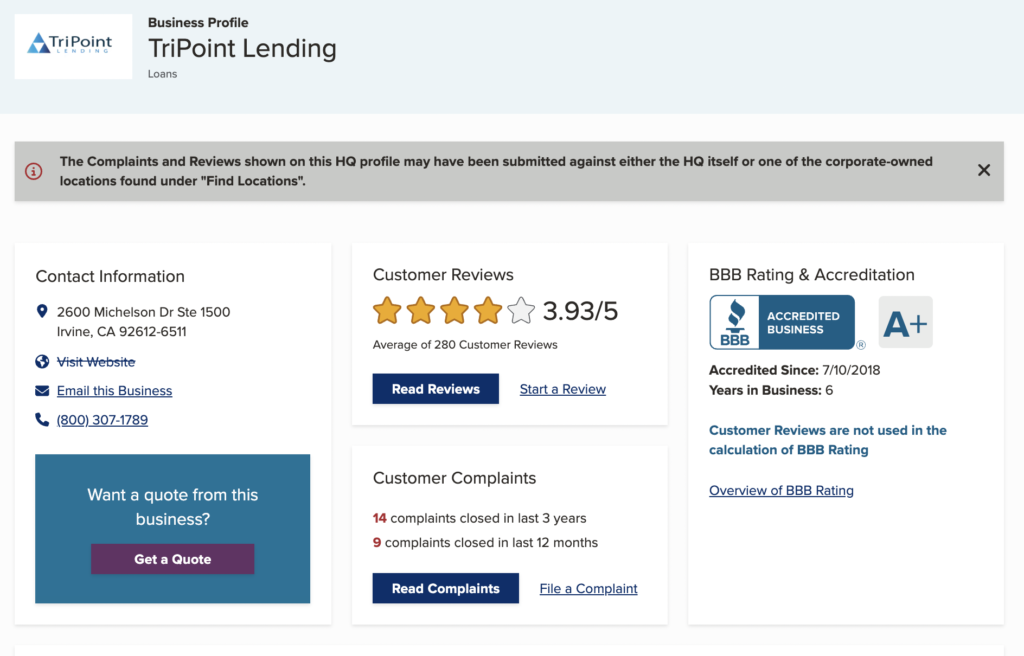

According to its BBB page, TriPoint Lending has been accredited since 2017. BBB states that the company covers loans, payday loans, and loan servicing. At the time of this review, TriPoint Lending had a 3.93 rating on BBB with an A+ rating. It also shows that the company has been accredited since 2018. That said, how much does TriPoint lending cost, and how much does debt relief cost in general?

Per BBB’s related businesses section, TriPoint Lending is related to Alleviate Financial Solutions.

2. How Much Does TriPoint Lending Cost?

At Ascend, we believe that debt settlement may be a good option, but it’s only in the context of understanding all of your options and the cost of that option. This is precisely why we built a free debt settlement cost calculator so you are MOST informed. The calculator will help you compare debt relief to other options and make the best decision for your financial situation.

Debt settlement can be much less expensive than your current obligations, but it is a debt relief option, meaning that there are debt settlement pros and cons associated with it. For example, while debt consolidation loans can help increase your credit score, debt settlement can hurt your credit score. Additionally, debt settlement can lead to tax consequences and potential lawsuits from creditors.

3. TriPoint Lending Reviews

Let’s look at the TriPoint Lending reviews, starting with BBB reviews, to help you make the most informed decision.

TriPoint BBB

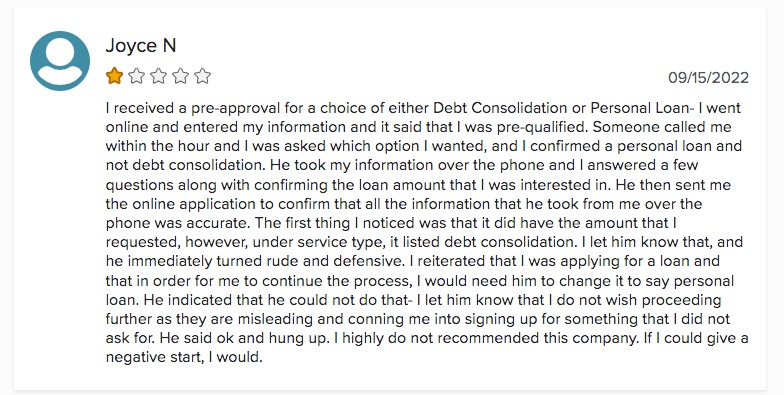

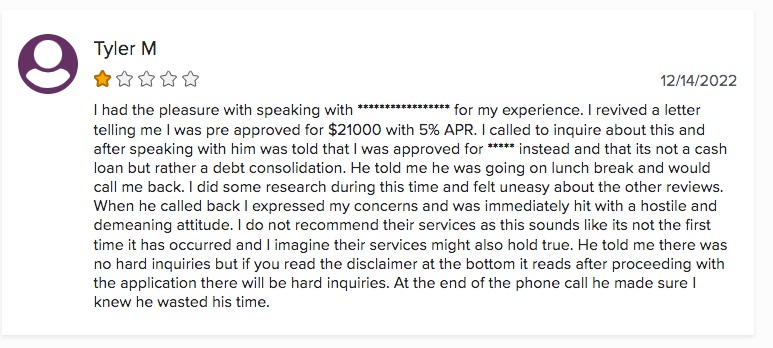

I found the BBB page, where they received a 3.93/5 and an A+ rating. The company has received 14 complaints in the last three years and 9 in the previous year. After reading many reviews, I realized some people were distraught with how TriPoint employees treated them.

One 5-star reviewer stated that the agent helped her a lot.

When going through the TriPoint Lending reviews via BBB and complaints, some people mentioned having negative experiences with the TriPoint employees they spoke to. A lot of people referred to them as “demeaning,” “rude,” “defensive,” and more. A few people also mentioned that the individual they spoke to at TriPoint would say going on a lunch break or needing to step into a meeting, but they would call them back. Some people never heard from them again, but those who did said that the TriPoint worker returned with new guidelines and information after their break.

Where Are Other TriPoint Lending Reviews?

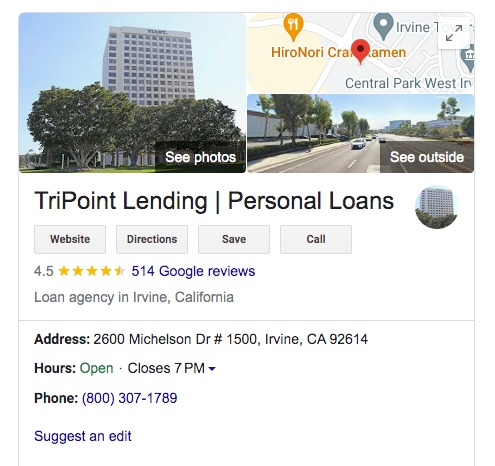

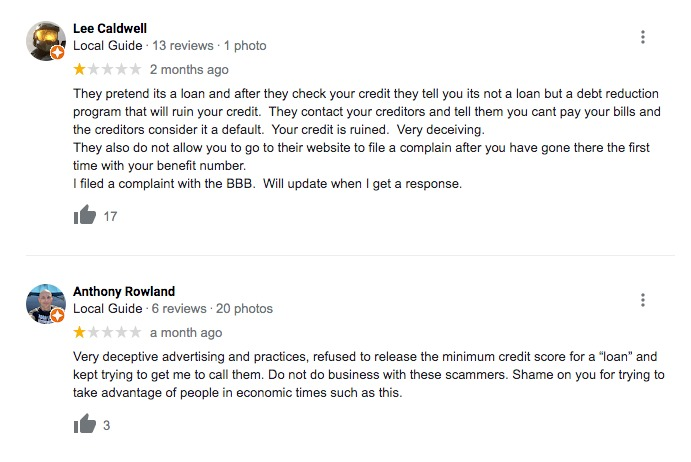

I found Google reviews for TriPoint Lending. They rated high with a 4.5/5. However, after reading many reviews, it was clear that only some were pleased with the service they received.

Here are some example reviews concerning TriPoint lending.

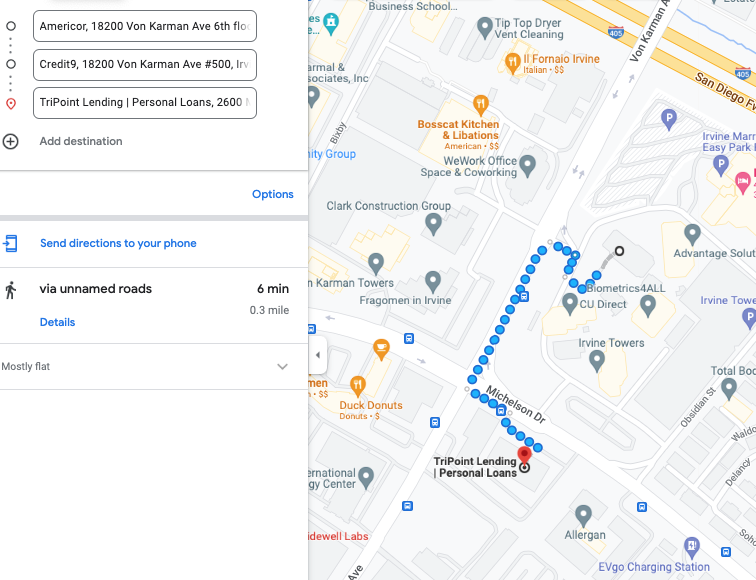

Another interesting thing to note is how close TriPoint Lending is to Credit9 lending and Americor Debt Relief. We just wrote a Credit9 and Americor review, and I noticed all three companies were in Irvine, CA. So, I Google-mapped the distance from one company to another, and see below what I found. Credit and Americor appear to be on the 5th and 6th floors of the same building, and TriPoint lending is just a 0.3-mile walk from both companies. This proximity suggests a potential business relationship or shared resources between these companies.

Let’s next go through legitimacy.

4. In Summary

It’s unclear to me whether TriPoint Lending provides loans.

From reading reviews and looking at the TriPoint lending mailer, TriPoint Lending is a company that markets itself for debt consolidation loans. One question I have is whether TriPoint Lending qualifies individuals to receive debt consolidation loans or if anyone gets a 6.95% interest rate. Or, potentially, it markets to people who can’t qualify for a loan but do qualify for a debt consolidation program, which is 100% different.

If you need debt consolidation, let’s discuss options next.

What If I Can’t Get a Debt Consolidation Loan Elsewhere?

If you can’t get a consolidation loan from Loyal Lending, what are your options? Are you putting more on your cards each month than reducing them? Do you have a high debt-to-income ratio? Remember, there are always options, even if a debt consolidation loan isn’t immediately available.

The challenge is that you may qualify for a debt consolidation loan, but the interest rate could be 29.99%, and the loan won’t consolidate all of your debt.

As stated above, if you have unaffordable debt, we built the free debt options and costs calculator below. It allows you to compare options such as non-profit credit counseling, debt settlement, and debt payoff planning. If you are already in financial hardship, the calculator also helps you understand bankruptcy. No email address is required unless you’d like some additional free assistance.

Leave a Reply