Did you get prequalified for a debt consolidation loan at under 4% interest rate, but then you got routed to Strategic Consulting who pitched you on a debt consolidation program?

What does this company do? What are the reviews? What’s currently happening with the Strategic Consulting lawsuit?

The purpose of this article is to explain how it works and what it does, so let’s get started.

What is Strategic Consulting?

I spoke with someone recently who we will call Dave. Dave stated that he received a debt consolidation loan mailer, and applied online, but was directed to Strategic Consulting.

Strategic Consulting mentioned that he did not qualify for a debt consolidation loan, but he did qualify for a debt consolidation program (also known as debt relief) via a law firm.

An important note – It seems like the names of the companies change, but that Strategic Consulting may be a link that remains similar. For example, per the BBB reviews and BBB complaints, Strategic Consulting has been linked to Loyal Lending and Patriot Funding’s mailer, and the individual I spoke with got sent to Level One Law. You may have been linked up with Clear Creek Legal Debt Consolidation via Panther Lending per one of Strategic Consulting’s recent BBB complaints.

The plan payment sounded great, so Dave decided to move forward and a notary was sent to him quickly to get him all signed up. After signing up, Dave felt a bit hesitant, so he reached out to us directly.

If You Are Looking For a Loan…

If you thought you were applying for a loan, you may be interested in a personal, unsecured loan to consolidate your debts.

As such, we partner with 3 different reputable companies that provide actual loans. These companies allow you to check your rate without a credit score impact (via soft credit pull) and do not charge prepayment penalties.

That said, let’s say you’ve exhausted your efforts and want to look at other ways to deal with your debt.

If You Are Looking for a Program…

Two of the main options when you cannot receive a loan is nonprofit credit counseling and debt settlement. A third option is filing for bankruptcy, but some want to keep that as a last resort.

If you are struggling and stressed out with debt, and you cannot continue making all of your debt payments, we built a free debt resolution option calculator below (that doesn’t even require an email address unless you want additional assistance).

We wanted to provide a free tool that can help you really compare and understand your option holistically without having to pay for something

Strategic Consulting Reviews

Firstly, I like to see when a company was established. When I check Strategic Consulting on Wayback Machine, it appears the website started around November, 2020. Secondly, I look at social media’s establishment date. Unfortunately, the link to Strategic Consulting’s Facebook account results in an error. Strategic Consulting’s Twitter was established in September 2020. Let’s look at the reviews.

BBB

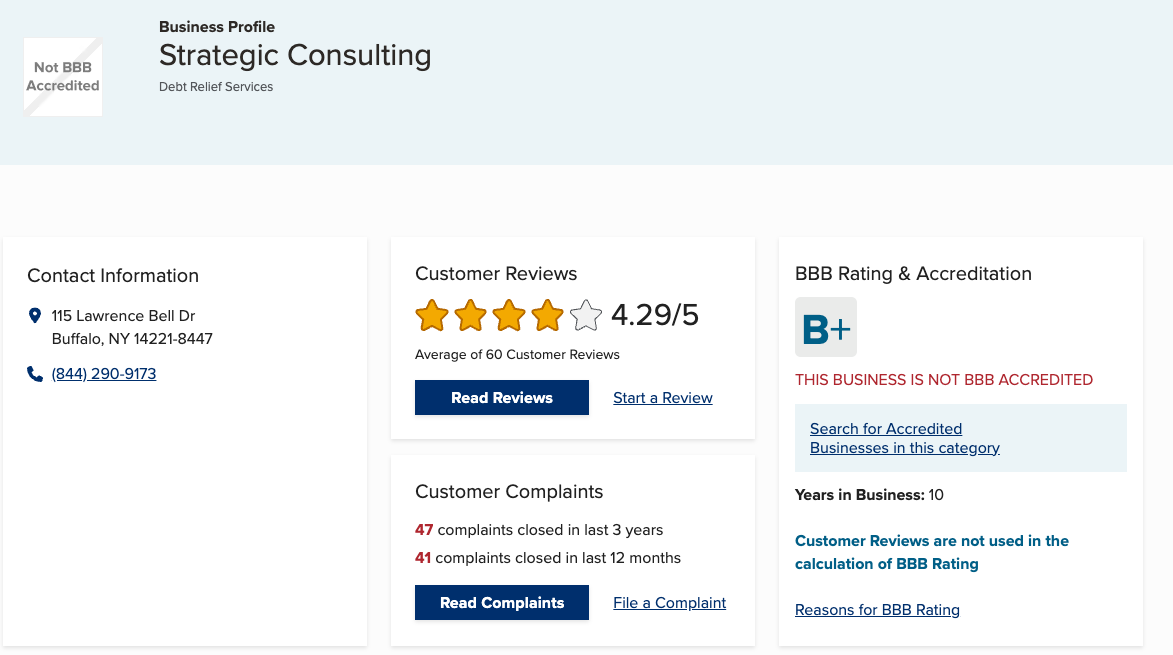

Strategic Consulting has a B+ on BBB with 4.29 rating, but is currently not BBB accredited. That said, it has 41 complaints in the last 12 months and 47 complaints in the last 3 years, meaning that the majority of the complaints came in the last 12 months.

So, I took a close look at the complaints, most recent descending.

It appears that many of the complaints address that they were looking for a loan and then got pitched a credit card consolidation (not a loan). Some individuals appear not to have liked the tone of the conversation.

On Google, Strategic Consulting has mostly positive reviews, so let’s take a look at that next.

On Google, Strategic Consulting has 4.8 rating out of 5. While the most recent reviews are negative, I found that there were many reviews that sung Strategic Consulting’s praises.

Here are two positive Strategic Consulting reviews that state they loved the explaining received, and one individual stated that he got approved for a loan and funded.

TrustPilot

Why The Discrepancy Between Positive and Negative Reviews?

One question you may have is how to deal with the discrepancy between the positive and negative reviews.

You may have to choose whether you are going to speak with them directly, but one thought may be that many different types of companies may hire Strategic Consulting for onboarding.

Some companies may use tactics such as the debt consolidation mailers, and others may use them for other types of services.

Debt Consolidation Loan vs Debt Consolidation Program

Before concluding, I thought it would be helpful to understand the differences between a debt consolidation loan and a debt consolidation program. While a debt consolidation program may be beneficial for you, it’s helpful to understand the differences.

Debt Consolidation Loan:

- You get the funds into your bank account or the funds are sent to payoff your creditors directly.

- You get an interest rate tied to the loan

- Your credit score may go up.

- You may have an origination fee.

- You do not get sued by creditors if you pay your creditors on time.

Debt Consolidation Program:

- You put funds into a special purpose escrow bank account to save to settle debt with the creditors. You do not receive funds.

- You do not get an interest rate as it’s not a loan.

- Your credit score may decrease significantly.

- There is no origination fee as it’s not a loan.

- You can get sued by creditors and debt collectors as your account fall behind.

- Your account fall behind

- You could pay taxes on forgiven debt.

What Should You Do?

Hopefully, understanding the Strategic Consulting reviews and how debt relief companies work can help you understand your next steps. It’s ultimately your decision and you understand your finances best.

If it’s helpful, please feel free to use the free debt resolution option calculator below to help you estimate the costs and duration of your different option.

Leave a Reply