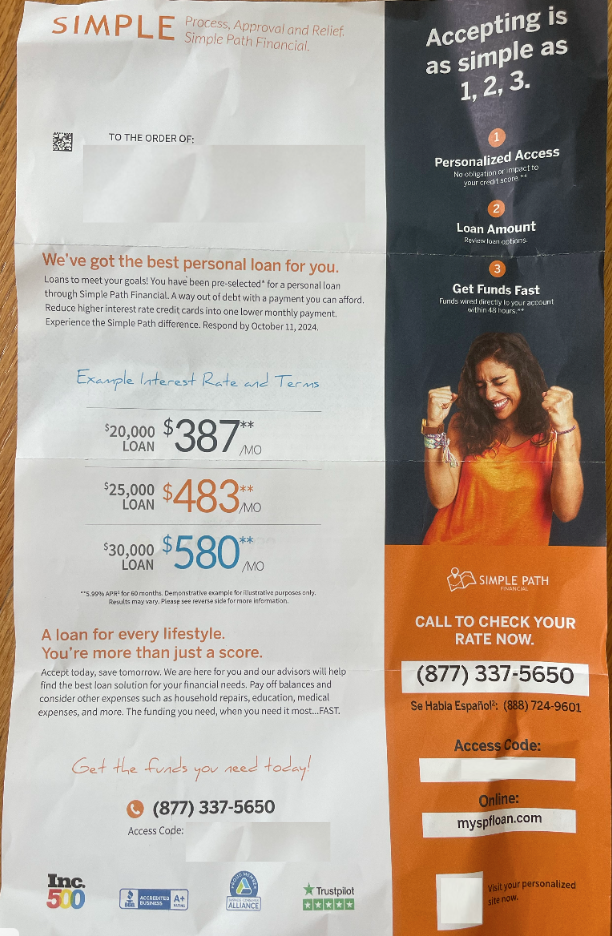

Did you receive a mailer from Simple Path Financial or see an ad on social media or another platform for a debt consolidation loan of 5.99%?

Furthermore, you may have seen a BBB review such as this one where James mentioned he didn’t qualify for a loan, but got pitched a debt consolidation program.

My name is Ben, and I have spent the last 5 years helping people understand the differences in options to help them eliminate debt cheaper, easier, and faster. I have uncovered debt consolidation scams. I was also one of the first to write an article covering the unfortunate Litigation Practice Group bankruptcy have spoken with countless people negatively affected by it.

I created “Your Debt Relief Pal” to help protect you from debt companies that may use deceptive marketing and provide you with realistic estimates of your options for debt freedom.

We will break down everything in this article in simple terms, so let’s get started.

1. What Is Simple Path Financial?

Simple Path Financial may be pitching debt consolidation loans or it may also be pitching debt settlement consolidation.

Many companies use mailers to pitch what looks like debt consolidation loans, but only alter do the individuals find out they qualify for debt settlement consolidation. Debt settlement consolidation can be beneficial, but it is not to be mistaken or confused with a debt consolidation loan where proceeds would be sent to your bank account.

Now, if you are looking for a debt consolidation loan, there are 3 debt consolidation loan companies that we have vetted that 1) Only do a soft check to check your credit 2) Do not charge prepayment penalties. With debt consolidation loans, it may be helpful to check your rate from multiple places to get the best rate.

If you aren’t able to qualify, then some individuals look at debt settlement, which we will cover the cost and pros and cons.

If you are unfamiliar, Debt settlement is the process in which a third party negotiates and settles with your creditor on your behalf. The goal of a debt settlement firm is to find a lower payment that will fully satisfy the debt that you owe. So, a debt settlement may try to settle a $10,000 credit card balance for $5,000. This can provide ample savings and a potentially lower monthly payment.

I was the previous CEO of a debt settlement company, and I believe debt settlement can be a good option for some, but not for others.

Now, if you are struggling with debt and wondering what to do next, we built a free, unbiased debt options comparison calculator (not even an email address is required) that provides a wide range of debt options that may be able to fit your budget. The data is personalized to your income and expenses, so you can get accurate costs, pros and cons, and options.

Let’s cover Simple Path Financial’s history next.

Simple Path Financial History

According to Simple Path Financial’s BBB page, the debt consolidation company has been in business for just over 5 years. At the time this article was written, Simple Path Financial has a 4.69 out of 5-star rating based on over 500 reviews on BBB. It also appears that they are a BBB Accredited business since May of 2017.

Many of the reviews may talk more about debt settlement programs rather than personal loans. It’s also interesting to note that one reviewer mentioned working with Freedom Debt Relief, a national debt relief company, in their review. While I couldn’t find an official connection tying the companies together, it is common for parent companies to open smaller branches to target specific populations.

2. How Much Does Simple Path Financial Cost?

Debt consolidation may be a good option, but it’s only in the context of understanding all of your options and understanding the cost of that option. This is exactly why we built a free debt settlement cost calculator so that you are MOST informed.

You may be looking for a debt consolidation loan, but do you qualify? Is your credit score good enough? Is your debt-to-income ratio or credit utilization good enough?

I helped build this free consolidation loan and other options calculator to help you compare your rates across multiple debt consolidation lenders and your options to other options if you cannot qualify for a loan. It’s specific to your financial information, so if you have $10,000 in debt, it will provide an estimate of your situation.

While the calculator cannot provide your exact Simple Path Financial debt settlement plan payment, it provides an estimate based on your personalized financial data and allows you to compare debt relief to other options.

You can then check your rate, which will NOT affect your credit score.

3. Simple Path Financial Reviews

Debt settlement can be much less expensive than your current obligations, but it is a debt relief option, meaning that there are debt settlement pros and cons associated with it. For example, while debt consolidation loans can help increase your credit score, debt settlement can hurt your credit score.

3. Simple Path Financial Reviews

Let’s next cover the BBB reviews, Google reviews, and TrustPilot reviews.

BBB Reviews

Simple Path Financial’s BBB page is very highly rated. With just over 550 reviews, the company has a 4.69 out of 5-star rating. And while this is an incredibly high rating, the reviews themselves are lacking any detail that might make them more trustworthy. Most reviews are simply pleasant without any explanation of the user’s experience throughout the process.

There have only been 8 total complaints over the past 3 years on Simple Path’s BBB page. Simple Path also has a 100% response rate to their complaints, meaning each complaint has been addressed by the company.

Here was a review that stood out to me as the individual specifically mentioned that the positive reviews were about the customer service, and not about the effectiveness of the product or the debt settlement consolidation.

Google Reviews

Similar to the BBB, Simple Path’s Google Reviews are incredibly high. With 437 reviews at the time this article was written, Simple Path has a 4.8 out of 5-star rating on Google. Unlike the BBB, the reviews found on Google seem to be incredibly thorough and detailed. Many users recount how easy it was to work with Simple Path to get a personal loan. The 5-star reviews do seem a little formulaic, which can be a red flag, so be sure to read through a wide variety of reviews to get a full picture of the company.

TrustPilot reviews

And finally, Simple Path Financial also has a spectacular TrustPilot score. With just over 1,000 reviews at the time this article was written, Simple Path Financial had an overall score of 4.9 out of 5 stars. Just like the BBB page, Simple Path Financial also has a high response rate to those who leave negative reviews. They typically attempt to reach out to those with complaints to resolve the issue at hand.

TrustPilot seems to be the platform that most users are actively leaving reviews on, with the most recent review — at the time this article was written — left only 10 hours ago. Many of the reviews do focus on a representative answering questions, which isn’t reviewing the actual service. Keep this in mind while reading through the reviews others leave.

In summary

Overall, it appears that other users who have worked with Simple Path Financial have been pleased with their services. When looking at their negative reviews, it appears that many people think they are a classic “bait and switch” company. This might mean that Simple Path may offer you a service they don’t intend on actually giving you — like a personal loan, for instance.

So if you are looking for a variety of options for debt consolidation, this company may be perfect for you! However, if you are specifically looking for a personal loan, you may not get what you are looking for with Simple Path.

What If I Can’t Get a Debt Consolidation Loan Elsewhere?

If you can’t get a consolidation loan from Simple Path Financial, what are your options? Are you putting more on your cards each month than reducing them? Do you have a high debt-to-income ratio?

The challenge is that you may qualify for a debt consolidation loan, but their interest rate could be 29.99% or the loan won’t consolidate all of your debt.

As stated above, if you have debt that is unaffordable, we built the free debt options and costs calculator below that allows you to compare options such as non-profit credit counseling, debt settlement, and debt payoff planning. If you are already in financial hardship, the calculator also allows you to understand bankruptcy. No email address is required unless you’d like some additional free assistance.

Leave a Reply