You are considering National Debt Relief and wondering how much in fees you are going to pay in the program. Did the National Debt Relief representative say the fee is “included in the plan”, but what does that mean?

As a previous CEO of a debt relief company, I know a lot about debt settlement fees. And I believe fees are one of the most important things to consider when deciding on a debt settlement company.

So, the purpose of this article is to get extremely granular on how much you will have to pay in fees.

Here’s what we will cover:

- How National Debt Relief Fees Work

- What Do Other Debt Relief Providers Charge?

- Other Debt Relief Program Fees

- When Does National Debt Relief Charge The Fees?

How Much Does National Debt Relief Charge?

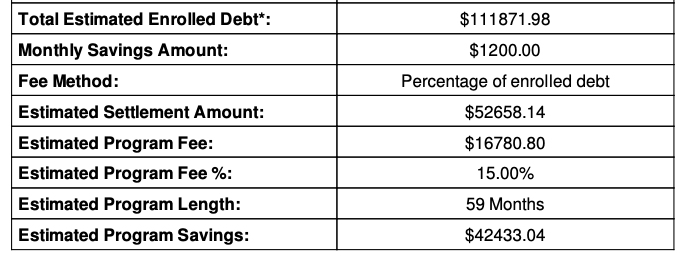

National Debt Relief charges the average client between 15-25% of the enrolled debt. That is a huge variance, and the difference can be thousands of dollars in fees between 15 and 25%. Fees also attribute why people have had negative experiences with National Debt Relief. Freedom Debt relief states its fees average 21.5%, so my hypothesis is that National Debt Relief would charge closer to 25% than 15%.

The fees charges are critical, so it’s really important to do your research. Check the following example of how much you may pay in fees with 15% vs 25%.

You can see that the individual paying 25% is paying $5,000 more for potentially the same type of program. That’s a huge amount.

Please note that the above example is based on someone who is tax insolvent. It’s also important to understand how tax consequences work in debt settlement.

Where Do You Find Your Fee Amount?

Unfortunately, most debt relief companies are not forthcoming about the fees. The best way to find what your National Debt Relief fees would be is by:

- Debt Negotiation Agreement (If you have one)

- Asking the National Debt Relief sales representative

The Debt Negotiation Agreement is about 20-page document that outlines the fees, what National Debt Relief will do for you, and other pertinent information about the program.

On or around page 3 of the Debt Negotiation Agreement, under the “Fees” section, you should see the % amount for your program. It may also include the estimated number of months and the annualized percentage basis. I do not consider the annualized percentage basis as this is not a loan. If you have not received a debt negotiation agreement yet, you may be able to find that exact amount from the National Debt Relief sales representative.

When we were a debt relief company, we would communicate the fee on the phone and also have it in easy to find place on the client services agreement. See an example below:

What Do Reputable Debt Relief Providers Charge?

One of the biggest things Ascend has worked towards is debt settlement fee transparency. As such, we built the following debt settlement fee calculator to allow you to compare fees between multiple debt settlement companies to help you make the most informed decision.

You can use the free resource below.

We also have helped many individuals do a consolidation of settlements to consolidate their settlement program into a program that charges much less in fees.

What Other Fees You May Owe

There are 2 other fees you will want to be cognizant of that may be associated with your National Debt Relief program, but are not charged by National Debt Relief.

Monthly Escrow Fee ($9-$15 monthly)

Firstly, you will most likely have to pay a monthly bank account escrow fee. This fee would be charged before the first settlement and would go to the payment processor handling the money movements, including your draft and settlements.

So, when you sign up for the program, you would set up this special purpose escrow bank account. This bank account will house all of your monthly drafts. When National Debt Relief settles an account, the payments would be taken from this account. National Debt Relief’s fees will also be drawn from this account.

The escrow bank account is owned by you, and National Debt Relief will present settlement offers to you, which you can accept or reject. Once accepted, this is when National Debt Relief can pull the fees and payments from this account.

Debt Settlement Legal Plan Fee ($25-100 monthly)

Because debt settlement companies can prevent debt collection lawsuits, many debt settlement companies pitch a legal plan. This can cost quite a bit of money. My view is that the debt settlement company you work with should know which debt collectors sue and prioritize those debts first to avoid this cost altogether.

For example, if your creditor’ has a low lawsuit likelihood, then what is the purpose of the additional fee of potentially around $3,000 – $4,000 over the life of the program.

When Does National Debt Relief Charge The Fees

Many debt settlement companies, including National Debt Relief, pitch that you do not have to pay the fees until after you have settled an account.

Please note this is not specific to National Debt Relief. Because debt settlement companies were charging fees before settlements, the FTC amended the Telemarketing Sales Rule in 2010 to include that debt relief companies cannot charge fees before the first settlement.

Let’s look at the following example of when fees may be charged. The example below estimates settlement at month 6, but that may vary.

So, you may see on your National Debt Relief dashboard that a payment of $325 was made to the creditor, but the full $2100 fee was taken out immediately.

In the above example, the first payment was made on 4/7/2022, and the fee was taken on 4/8/2022 for the full amount. Actual results may vary. You will also notice that the 21% fee in this example is based on the enrolled debt amount, not the balance owed at settlement.

Finally, the fee is taken after each settled debt, not on all of the accounts at once.

Conclusion

National Debt Relief quotes a fee range between 15-25% of your enrolled debt. That is a big variance with a 25% fee costing you potentially thousands or tens of thousands of more dollars over the life of the program. You can also consider the pros and cons of National Debt Relief’s program when making the decision.

Hopefully, you now understand how National Debt Relief fees work, when they charge you those fees, and alternative debt relief program fees to help you make the most informed decision.

Leave a Reply