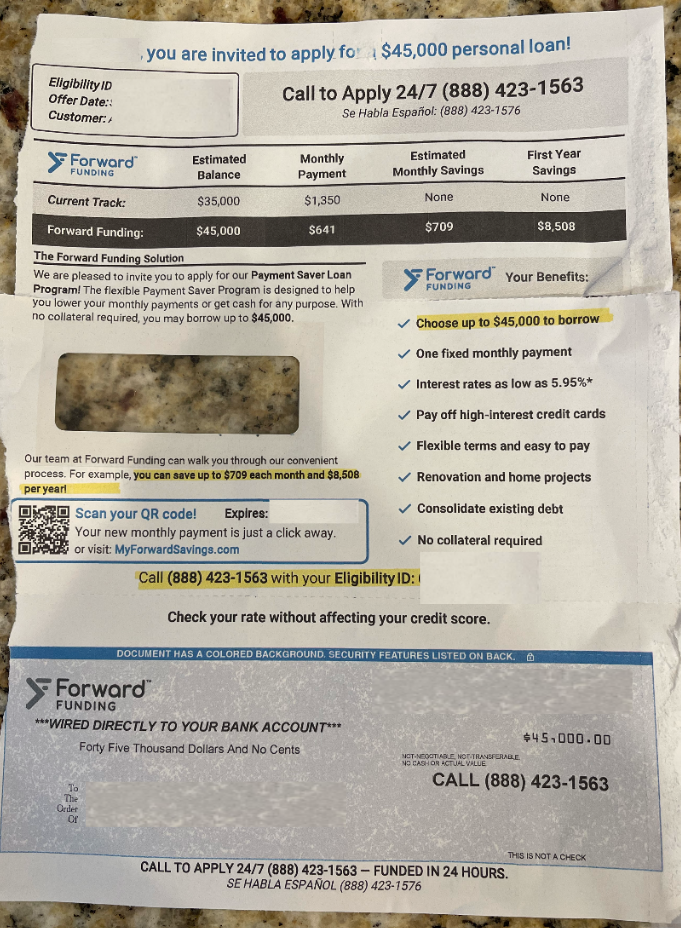

I had a call today with someone who got pre-selected for a loan, but did not qualify for the loan, but did qualify for a debt consolidation program (also known as debt relief/debt settlement).

The program rate was over 50% less than what she was paying, but after the call with the representative, she had some questions about the program.

The gal ended up enrolling in the debt relief program, but was wondering what the potential cons of signing up for debt

Let’s look at the reviews I found.

My Initial Review

I write a lot on debt companies because I always like to understand whether how long these companies have been around, and what may be going on behind the scenes.

What I found interesting about Forward Funding is that the website may be quite new. I used Wayback machine to check how long a website might have been around, and it states that the website’s scrape was just March 23, 2024, about a month ago.

I am also curious why Forward Funding states that states it has a lending license that you can click on (source: forwardfunding.com/licenses/), but it is not a link.

Reviews

Forward Funding has maintained mostly positive reviews on TrustPilot with a 4.6 rating based on 33 reviews.

A positive reviews mentions that the company has helped them manage their debt.

A negative review questions the legitimacy of the positive reviews.

Let’s look at the BBB rating and reviews.

BBB

Forward Funding has mostly positive reviews on BBB with a 4.85 based on 26 reviews. The BBB file was just opened in November 20, 2023.

Conclusion

At this point, I do not have enough information to understand what exactly this company does. Do many people get the pre-approved loan or do many of the people end up going to a debt consolidation program?

Leave a Reply