Did you receive a mailer from Simple Debt Solutions or another entity stating that you were pre-approved for a loan? Did you get rejected for the loan (although pre-approved) but get approved for a debt relief program through 5 Lakes Law Group? You may be wondering who they are or how their fees compare to those of other debt relief companies.

My name is Ben, and I have spent the last five years helping people understand the differences in options to help them eliminate debt cheaper, easier, and faster. I have also uncovered debt consolidation scams. I was also one of the first to write an article covering the unfortunate Litigation Practice Group bankruptcy and have spoken with countless people negatively affected by it.

I created “Your Debt Relief Pal” to help protect you from debt companies that may use deceptive marketing and provide you with realistic estimates of your options for debt freedom.

Who is Five Lakes Law Group? Should you continue to work with them? How do their rates compare to other companies? What do reviews online say about them? We will cover all of that and more in this article.

What is Five Lakes Law Group?

I became aware of Five Lakes recently when speaking with someone on the phone. It appears that they were looking for a debt consolidation loan but eventually got in touch with a debt relief company that referred them to Five Lakes because the original debt relief company could not work in the individual’s state. I saw this example again with Simple Debt Solutions.

It seems as though Five Lakes may be more expensive than other companies, as we first heard about them from a phone call with someone we will call Rachel. Rachel had a 55-month plan with 28% fees at $580/month. However, it seems like there may be a legal plan associated with that as well because fees seemed higher than because her debt amount was 36,500, so at $580 for 55 months, in total, she would be paying 32,065, which when you divide that by $36,000 you get an 89% payback of her debt. Most debt settlement companies estimate 50% debt settlement, meaning Five Lakes charges between 35-39% in fees.

It is unclear if Five Lakes is a referral company, and individuals like Rachel will eventually be referred to a new company, as she was pushed into Five Lakes. It is important to note that you should read the contract before signing up with a debt relief company to see how the cancellation process works. If they refer you to a new company mid-program, you do not want to continue the program.

Understand Your Options!!!

You may be looking for a debt consolidation loan, but do you qualify? Is your credit score good enough? Is your debt-to-income ratio or credit utilization good enough?

I helped build this free consolidation loan and other options calculator to help you compare your rates across multiple debt consolidation lenders and your options to other options if you cannot qualify for a loan. It’s specific to your financial information, so if you have $10,000 in debt, it will estimate your situation.

Let’s cover Five Lakes Law Group’s history next.

Five Lakes Law Group History

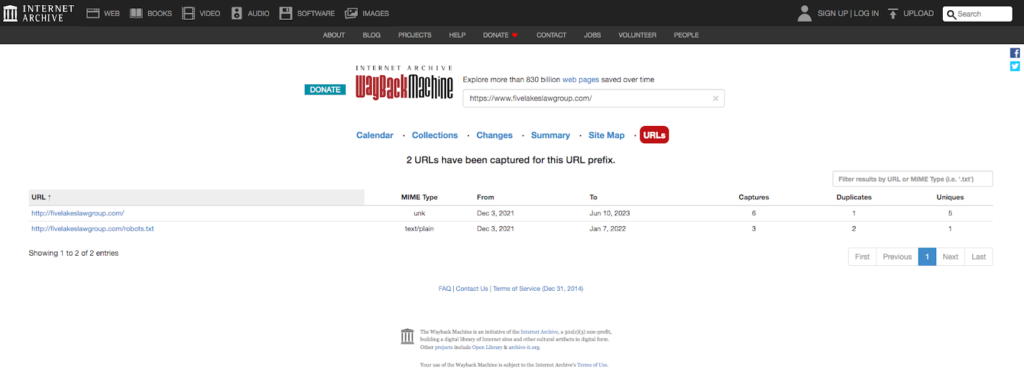

While I could not find much information on Five Lakes’ history, I did notice that its website has been on the Wayback Machine only since December 2021, meaning it is much newer than other debt relief companies.

Five Lakes Law Group Reviews

I was able to find many reviews for Five Lakes.

BBB

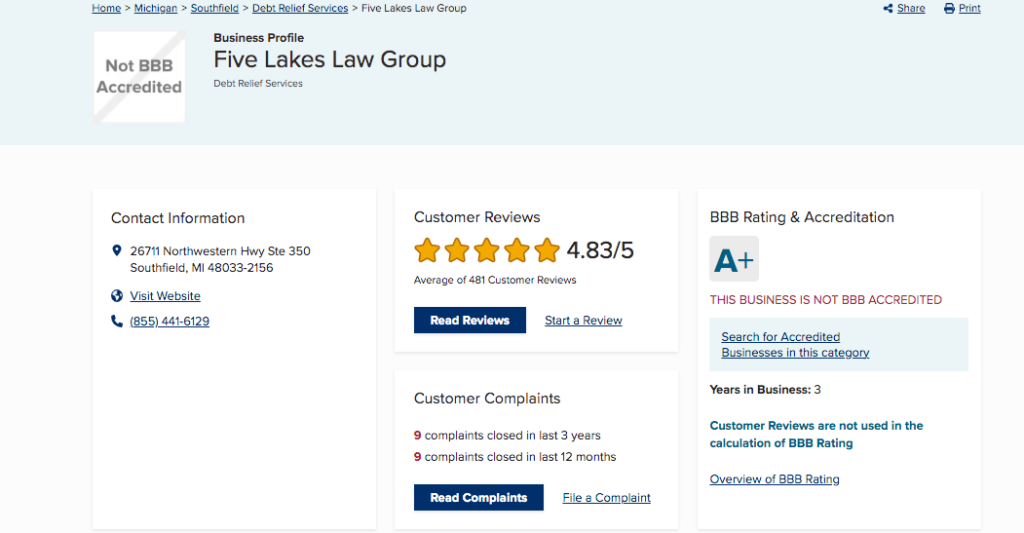

I found Five Lakes’ BBB page, which gave them a 4.83/5 and an A+ rating. However, noted in red, Five Lakes is not BBB Accredited.

I was able to read some complaints about Five Lakes to see what other people had been experiencing. A common theme I noticed in many of the complaints was the lack of communication and the feeling that Five Lakes did not fully explain the process or the fee percentage upfront.

Let’s see if we can find any Five Lakes reviews.

Google Reviews

I was able to find Five Lakes reviews on Google. They have a 4.5/5, with many people saying they are feeling stress-free so far. I noticed a lot of reviews have come in the past week, so I am wondering if they are asking their clients to write reviews about their experience so far. A lot of reviews start with “so far,” which makes me wonder how long they have been working with Five Lakes.

I also found some very negative reviews about Five Lakes. The reviews urge you to not waste your time and either negotiate with your creditors on your own, or use a different company. There is a lack of communication, urgency and they will not provide information in writing.

TrustPilot Reviews

I also found Five Lakes Law Group on TrustPilot, which had many good reviews. Similar to my findings on Google, they had a ton of five-star reviews every day, which makes me think they are asking people to rate their conversations after barely beginning the program.

However, there are negative reviews as well, stating that they are very hard to get in touch with and claim they have made settlements when they potentially haven’t.

Closing Thoughts

From my research, I realize I am unsure how Five Lakes operates.

One question I have is whether Five Lakes negotiates with creditors directly or whether they work with another entity. I am also unclear on what the average fee 5 Lakes Law Group charges and whether Rachael’s experience was an anomaly or the norm. It is important to be knowledgeable about all of your debt relief options. If you want to explore all your options, use our free calculator below.

Leave a Reply