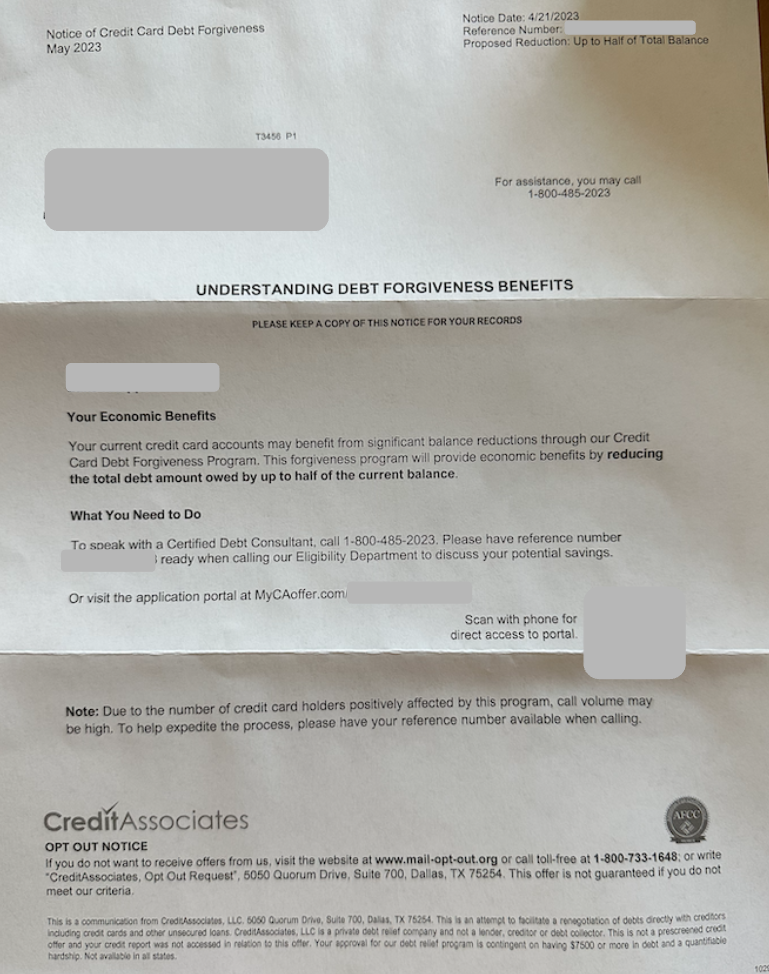

Did you receive a mailer from CreditAssociates similar to the one below that says you may benefit from a credit card debt forgiveness program? Was the call to action to call the eligibility department?

What exactly is Credit Associates, and will Credit Associates negatively affect your credit?

That is exactly what we are going to look at. Let’s start with covering what products CreditAssociates offers.

My name is Ben, and I have spent the last 5 years helping people understand the differences in options to help them eliminate debt cheaper, easier, and faster. I have uncovered debt consolidation scams. I was also one of the first to write an article covering the unfortunate Litigation Practice Group bankruptcy have spoken with countless people negatively affected by it.

I created “Your Debt Relief Pal” to help protect you from debt companies that may use deceptive marketing and provide you with realistic estimates of your options for debt freedom.

1. What is CreditAssociates?

CreditAssociates pitches a product called debt settlement (also known as debt relief and debt consolidation programs). If you are not familiar, Debt settlement is the process in which a third party negotiates with your creditor on your behalf. The goal of a debt settlement firm is to negotiate a lower balance from say $10,000 to $5,000 to provide you debt relief. I was the previous CEO of a debt settlement company, and I know that debt settlement may be a good option, but it also may not be compared to other options. One of the things I look for is the mailer itself, and to be honest, Credit Associates seems to have one of the most honest mailers, not focusing on too good to be tacts or scare tactics, which I appreciate.

Debt settlement may be a great option for you, but it’s helpful to understand each of your options.

Now, if you are struggling with debt and wondering what to do next, we built a free, unbiased debt options comparison calculator (not even an email address is required) that provides a wide range of debt options that may be able to fit your budget. The data is personalized to your income and expenses, so you can get accurate costs, pros and cons, and options.Let’s next cover Credit Associate’s history.

CreditAssociates History

According to BBB, CreditAssociates has been a company since 2016, and is headquartered in Dallas, TX. The company focuses primarily on credit card debt settlement. According to its website, it has helped thousands of its customers settle millions of dollars in debt. CreditAssociates offer free financial consultation to prospective clients. This consultation is aimed at discussing qualifications to become their client. Once they draft your savings plan, you can ruminate on it, and decide if you’re willing to work with them. One criterion to fulfill before they can handle your debt is to have a minimum of $10,000 in debt. Another salient criterion is to demonstrate capacity and willingness for regular debt payments. If you meet their criteria and are qualified to enroll, the company immediately initiates the negotiation process. It will then coordinate the debt settlement process.

The length of its debt settlement company depends on each consumer’s financial predicament. However, it claims to get the job done within 24 to 36 months of initiating a debt settlement plan. Although the company’s primary area of focus is credit card debt, it also assists in personal loans. It can’t help to reduce secured debt like vehicle loans, home equity loans, or mortgage loans since it only provides debt settlement.

2. How Much Does CreditAssociates Cost?

At Ascend, we believe that debt settlement may be a good option, but it’s only in the context of understanding all of your options and understanding the cost of that option.

You may be looking for a debt consolidation loan, but do you qualify? Is your credit score good enough? Is your debt-to-income ratio or credit utilization good enough?

I helped build this free consolidation loan and other options calculator to help you compare your rates across multiple debt consolidation lenders and your options to other options if you cannot qualify for a loan. It’s specific to your financial information, so if you have $10,000 in debt, it will provide an estimate of your situation.

If you do check your rate, understand the interest rate and the origination fee to see how much you will save by consolidating your debt. The above options do not charge prepayment penalties and have fixed rates, but if you use a different lender, these are important characteristics to look for.

3. CreditAssociates Reviews

Having a holistic and objective review of a debt relief agency can be difficult. Quite often, the company contracts writers to put up favorable reviews about their service. And in extreme cases, competitors hire people to put up damaging reviews about competitors.

To help you have the right perception of what consumers truly think, we’ll discuss reviews from 5 reputable platforms. Let’s go:

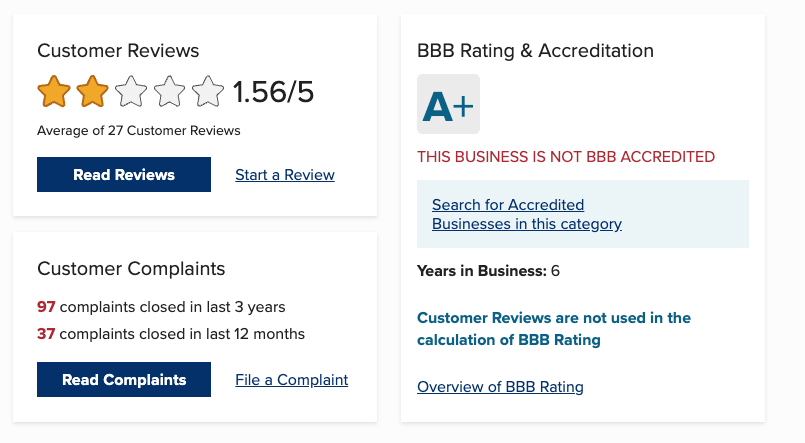

BBB Reviews

CreditAssociates has an average rating of 1.56 on BBB, based on 27 reviews. That said, it still does maintain an A+ rating, so I am not exactly sure how the rating system is setup on BBB. CreditAssociates also has 37 complaints in the last 12 months and 97 complaints in the last 3 years based on the time of this writing.

Consumer Affairs

The reviews on Consumer Affairs the company’s debt relief process is outrightly straightforward. The details of their agreement are easy to understand, even without legal help. Consumers just have to hand over some specific information, the team then carries out its initial analysis and decides whether they can help. They’ll also communicate the price to you beforehand.

The company’s representative also explains how it works, and how they’re the best fit for the negotiation process.

However, its reviews on Consumer Affairs are not all positive. A major complaint from consumers leaving 2 -3 star reviews is that the negotiation process takes too long.

At the time of writing this article, CreditAssociates has an overall rating score of 4.3 on Consumer Affairs. This is based on the 360 reviews it has gotten from verified buyers.

Google Reviews

Overall, CreditAssociates has an average review of 3.1 on Google. The total number of reviews it has on the platform is 53.

CreditAssociates reviews on Google fall on both extreme sides. Nearly half of the reviews gave them five stars, while the other half settled for one star. Only a few seem to be in the middle.

The strong point for those praising the company is its ability to resolve the debt. A particular user mentioned how it has helped in getting rid of half of its debt. The reviews claimed the representatives are very polite, and they take the time to explain how things work.

For the poor reviews, CreditAssociates were majorly scolded for being too costly. An unhappy past client noted that although the company helped settle a debt well below what she owed. But she paid a hefty price–equal to a quarter of original debt. Order debtors whose payments were in the negotiating process also filed lawsuits against her. The debtor warns order users to be careful of the company.

The Balance Review

CreditAssociates has a rating of 2.9 on The Balance. The platform shares its opinion on the debt relief company.

The balance noted that although Credit Associates is certified by major industry associations, it’s still shady in its dealings. They noted that they’re not fully transparent about what’s going on, and their communication is not ideal. As such, they suggest considering other options.

The balance also noted that Credit Associates has some pros. These pros include the fact that they’re accredited by IAPDA and AFFCC. They also offer support every day, except Sunday, and they have a client portal where you can monitor your account.

Some cons highlighted by The Balance is that services aren’t available in all states. Their fees are sometimes not fully disclosed, and only individuals in hardship can qualify.

Best Company

Credit Associates has a total of 326 reviews on Best Company. Platform users rate it 4.4, out of which 66% is a 5-star rating.

In one of their 5-star reviews, the user says they’ll save her over 5 grand, concluding that they’re trustworthy. She further reiterated that they only require information to pursue a settlement. She praises their communication, especially their ability to work her through and inform her of every step.

Sum of All CreditAssociates Reviews

When you sum up their rating from all 6 review sites, you’ll get an average of 3.05.

4. CreditAssociates Fees

CreditAssociates won’t charge you any fee in advance when they help you with debt negotiation. Rather, you’ll only pay a fee if you accept the settlement struck on your behalf. CreditAssociates withdraws their service cost and settlement payment from a Special Purpose Savings Account.

However, when they make their deductions, it may be as much as 20% of your original debt sum.

CreditAssociates don’t provide sample costs, which vary with state regulations. Speak with a representative on fees during the free consultation period.

We’ll advise that you discuss with a financial expert on taxes you owe on the canceled debt. You may get a tax exemption on passive income.

5. Pros and Cons of CreditAssociates

Thinking of opting for CreditAssociates for debt relief? It’s best to first elucidate its pros and cons to understand the choice you’re about to make.

Pros

Let’s consider some great aspects of the Credit Associates debt relief service. Here are a few of its multiple pros:

- They eliminate debt faster

- They offer you a team of experts to counsel you

- Offer hope for people without alternative

Let’s discuss each of these points:

Benefit 1: They Eliminate Debt Faster

CreditAssociates completes the debt negotiation process within 36 months. This gives debtors quicker debt exiting time than keeping to the original payment schedule.

Benefit 2: Enjoy Advice from Experts

It’s intimidating and difficult trying to exit debt on your own. However, there are alternatives to help with this, although they don’t always work. With CreditAssociates, you’ll have industry experts providing you guidance. They have experience in helping others to negotiate debt and can easily assist with yours.

Benefit 3: The Work With People Without Option

A whole lot of people are seriously indebted and don’t seem to have a way out. If you’re in this predicament, both bankruptcy and debt consolidation don’t seem possible. Then approaching CreditAssociates for help maybe your only option.

Cons

Credit Associates has a number of cons to consider. These demerits will open your eyes to something to consider, that may be detrimental to your finances. Some cons to using CreditAssociates are:

- It will harm your credit

- CreditAssociates is not available across all states

- Fees are not disclosed

It Harms Credit

Basically, CreditAssociates require you to stop sending money to credits and instead send those payments to CreditAssociates. The company then holds your money in a special savings account.

While you’re doing this, your credit score is being affected as you’re not meeting your debt obligation.

It’s not available in All States

CreditAssociates is not available for debt negotiation in every state. These states are Ohio, Wyoming, Vermont, Maryland, Minnesota, Connecticut, and Colorado.

No Guarantee of Success

There is no certainty of getting a debt discharge with this option. Imagine getting your credit score reduced to the trash and not still achieving your aim. It’s best to understand this reality before favoring the process.

CreditAssociates clearly elucidated on its website that every individual’s situation is peculiar, and can’t guarantee results.

Alternatives to CreditAssociates

The cons of debt settlement are quite significant. One such is that there’s no guarantee it’ll work. Also, a 15%-25% fee is outrightly exorbitant. If you’re considering an alternative to debt settlement, here are other options to try:

- Negotiate with creditors yourself

- File for bankruptcy

- Sign-up for debt management

Summary

Hopefully, you have a better understanding now of how CreditAssociates works.

If you are facing a financial hardship, it can be helpful to understand all your options. As such, please consider taking our free cost and options calculator below.

Leave a Reply