This article is for informational purposes only and should not be construed as legal or financial advice.

If you’ve been scrolling through TikTok, Instagram, or Facebook lately, there is a high chance you have seen an ad from TurboDebt. An example ad below features an excited man walking outside and explaining how TurboDebt can save you from financial ruin. He promises that your credit score won’t be ruined and that you won’t have to pay back what you borrow. It all sounds way too good to be true — and, unfortunately, it may be.

If you still need to see it, here’s the example below.

So, what exactly is TurboDebt? Why are they able to make these claims?

That is exactly what we are going to look at. Keep reading to discover the truth behind TurboDebt’s outrageous promises and learn what they really do instead.

My name is Ben, and I have spent the last 5 years helping people understand the differences in options to help them eliminate debt cheaper, easier, and faster. I have uncovered debt consolidation scams. I was also one of the first to write an article covering the unfortunate Litigation Practice Group bankruptcy have spoken with countless people negatively affected by it.

I created “Your Debt Relief Pal” to help protect you from any debt company that may have deceptive marketing and provide you with realistic estimates of your options for debt freedom.

So, you are looking for a debt consolidation loan, so let’s see exactly what Try Pennie offers. Also, many people I speak with CANNOT get a loan, so some deceptive marketing companies pitch things too good to be true so that they essentially bait and switch you into something else. I do not know if Try Pennie does this, but it’s important to understand. I will address your options later.

What is TurboDebt?

On the surface, TurboDebt markets itself as either a debt relief company or a marketing firm for other debt relief companies specializing in debt settlement. Debt settlement is when a third party negotiates with your creditor on your behalf. The goal of a debt settlement firm is to find a lower payment that will fully satisfy the debt that you owe.

Debt settlement may be an excellent option for you. Still, it’s helpful to understand each option, including non-profit credit counseling and bankruptcy, as there are definite cons to debt settlement. Here are some of the critical cons to consider:

Now, if you are struggling with making payments on your debt and wondering what to do next, we built a free, unbiased debt options comparison calculator (not even an email address is required) that provides a wide range of debt options that may be able to fit your budget. The data is personalized to your income and expenses, so you can get accurate costs, pros and cons, and options.

Let’s next cover Turbo Debt’s history.

TurboDebt History

TurboDebt appears to be a newer entity.

In an earlier article, we did a deep dive into TurboDebt’s history, and learned that the company only has a digital presence that dates back to March 24, 2020. This means that TurboDebt is just over two and a half years when this article was updated. The brevity of the company’s history is interesting when compared to the amount of reviews it has.

In fact, TurboDebt has amassed almost as many Google reviews in 2 years as National Debt Relief acquired over a span of 13 years. With over 2,000 reviews, TurboDebt has earned a 4.9 out of 5 star rating on Google. In addition, Turbo Debt commands over 3,900 reviews on TrustPilot with the most recent reviewing coming today, and the oldest positive review from August 26, 2021. Also, at the time of this writing, I could not find any TurboDebt BBB accreditation.

So, you’re probably wondering how much debt relief companies like TurboDebt may cost you each month.

How Much Does TurboDebt Cost?

Sometimes it’s difficult to understand the exact fee % you are paying if you’ve received a quote for a debt relief company, so this free debt relief fee estimator can help you estimate the exact fee % and compare options.

At Your Debt Relief Pal, we believe that debt settlement may be a good option, but it’s only in the context of understanding all of your options and understanding the cost of that option. This is exactly why we built a free debt relief cost comparison calculator so that you are MOST informed.

We know that TurboDebt refers you to other debt relief companies that may cost between 20-25% of enrolled debt, which can be quite expensive. Check out how much that will cost using our free debt relief cost calculator that will estimate your MONTHLY payment that you can compare to what you’re paying now.

I helped build this free consolidation loan and other options calculator to help you compare your rates across multiple debt consolidation lenders and your options to other options if you cannot qualify for a loan. It’s specific to your financial information, so if you have $10,000 in debt, it will provide an estimate of your situation.

You can then check your rate, which will NOT affect your credit score.

If you do check your rate, understand the interest rate and the origination fee.

Confirm that the lender does not charge prepayment penalties and that it’s a fixed rate.

If you ALREADY got a quote from TurboDebt, compare that quote to other companies that provide the same service. You may be surprised by how much you will save by just working with a different company.

However, are those Turbo Debt reviews well-earned? Let’s take a look at the cost and how TurboDebt reviews function.

How Does TurboDebt Function?

According to TurboDebt’s Google My Business Page, Turbo Debt is an exclusive partner of National Debt Relief, which means that TurboDebt refers you to National Debt Relief and potentially earns a commission. So, in order to understand what your full experience may be, it could really be helpful to read the National Debt Relief reviews.

Let’s understand TurboDebt reviews and how the company may function.

Understand the Turbo Debt Reviews

The Turbo Debt reviews are extremely positive. One question is when did Turbo Debt request a review from the individual? Is TurboDebt requesting a review after you’ve just been promised that your debt burden will be eliminated?

If you are considering debt relief, you may consider the following:

1. TurboDebt’s Other TrustPilot Reviews

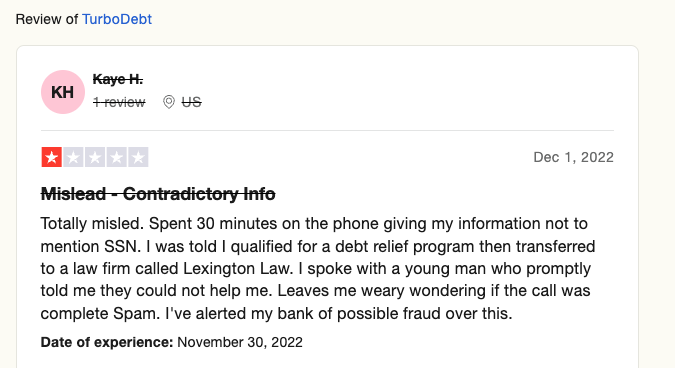

It may be helpful to review specific Trustpilot reviews. For example, take this example where the individual was attempting to transfer someone to Lexington Law, only to not qualify.

2. National Debt Relief reviews

If you’re working with National Debt Relief, it could be helpful to review National Debt Relief’s 254 BBB complaints in the last 3 years or one of our articles covering National Debt relief.

Understand the Sign Up and Day to Day Process

Let’s look at a review where Heather got connected to Turbo Debt to get placed into the National Debt Relief program.

For example, check out this recent Trust Pilot review.

There are many reviews on Google from confused clients who thought they were going to work with TurboDebt. However, they quickly got handed off to another company. According to TurboDebt’s own website, their goal is to “connect clients to debt relief programs that fit their unique needs.” This means that TurboDebt’s function is essentially to market to the population, find relevant leads, and match them to one of the companies they are partnered with.

Most likely, this means that TurboDebt makes money off of sponsorships from its partnered companies. Unfortunately, when company recommendations are tied to profit, two things are likely:

- TurboDebt’s recommendations may be based off of who is paying the best, not which company matches your situation the best.

- There is a chance that what you pay to the company you are matched to will be inflated to make up for the cost in connecting with you.

So Do You Actually Work With TurboDebt?

There may be a period of time where you actually work with TurboDebt, but that will only be spent figuring out which company to work with. Once the connection has been made, it is likely you will not be in contact with TurboDebt again. Even if you do get back in touch with TurboDebt, they will not have any information on how your case is being handled.

In short, no, you will not be working extensively with TurboDebt.

Are TurboDebt’s Claims Accurate?

Unfortunately, their claims that your credit score will not be impacted and you won’t have to pay them anything may not tell you the full story.

Technically speaking, since they are just the middle-man that connects you to a debt settlement company, they can make their big claims. This is because their free consultation only matches you to a company and does not actually interfere with your financial accounts.

So while, yes, technically your credit score won’t be hurt and you won’t have to pay them back, the claim still instills a sense that these are true for debt settlement as a whole. At the end of the day, TurboDebt connects individuals to debt settlement programs. Debt settlement DOES in fact lower your credit score significantly and is not without cost. In most cases, you will still owe a percentage of your debt as well as a fee to the company who negotiates the debt on your behalf.

Alternatives to TurboDebt

If TurboDebt isn’t what you thought it was, and you are still looking for debt relief options, you still have some choices! Depending on where you are at in your debt relief journey, there are many things you can do. Here are just a few examples:

Debt Management

If the lack of credit score impact and no extra payments intrigued you, then consider looking into debt management. There is still a chance that your credit score will be slightly impacted, but not nearly as bad as some of the other debt relief options. Basically, debt management allows you to look at your debt payments as a whole and break them down into more manageable and organized payments. Sometimes this includes asking your creditors for smaller payments, or a break in payments, but you will still be paying off the entirety of the debt.

Debt Settlement (Lesser expensive)

Ultimately, TurboDebt is connecting you to a debt settlement firm. However, your rate may be inflated because of the cost of customer acquisition is high. Instead, do research on the best debt settlement companies and contact them yourself! While your credit score may still be impacted, you could potentially save a little bit on the cost.

Bankruptcy

If paying off your debt isn’t an option, then bankruptcy might be your best bet. While you will definitely see a drop in your credit score, there is a chance that bankruptcy is the lowest cost option you have.

The free debt relief cost calculator provides a personalized estimate of each of these options based on your unique expenses.

Conclusion

Overall, TurboDebt is a marketing company that refers individuals to National Debt Relief.

Make sure you understand what TurboDebt is before you begin working with them.

Leave a Reply