Did Patriot Funding send you a pre-qualification mailer similar to the one below for a debt consolidation loan at a 3.87% interest rate?

Have you never heard of this company? Will you actually get the loan if you “apply”?

We will cover all that and more, so let’s get started.

What is Patriot Funding?

I became aware of Patriot Funding recently when searching for another company that provides similar types of mailers called Loyal Lending. Loyal Lending appears to send similar mailers stating that you prequalify for a debt consolidation loan under 4%, but it appears that individuals may not actually qualify for a loan, but do qualify for a debt consolidation program. Please note that another name for a debt consolidation program is called debt relief.

In that situation, the original company like Patriot Funding does not actually provide loans or the debt consolidation program, but is actually a marketing company that markets debt consolidation programs (debt relief) for other companies.

There is a huge difference between debt consolidation programs and debt consolidation loans. With debt consolidation loans, you get money in your bank accounts that you use to payoff debt. With debt consolidation programs, you end up letting your accounts go behind and then settling those accounts. Now, if you are looking for a debt consolidation loan, there are 3 debt consolidation loan companies below that we have vetted 1) Only do a soft check to check your credit, so checking your rate DOES NOT AFFECT your credit. 2) Do not charge prepayment penalties. With debt consolidation loans, it may be helpful to check your rate from multiple places to get the best rate. If you aren’t able to qualify, then some individuals look at debt settlement.

Important: Also, just as a note to be 100% transparent, Ascend is a for profit business, and we do our best to be unbiased in our reviews of companies. The only reason we write reviews such as these is because we do not believe in the marketing tactic to ‘prequalify’ individuals for a debt consolidation loan that you may not actually be able to get. When writing this article, one question we found ourselves asking was, “Does Patriot Funding have permissible purpose to prescreen you via the credit reporting agency and are they providing a firm offer of credit at a 3.87% interest rate, but is anyone actually getting that firm offer of credit in a loan for under the federal funds rate of 5.0 – 5.25%?”

We provide the 3 debt consolidation loan options below because we believe that you were looking for a loan, but may not actually have been able to check your rate for a loan. That said, it’s important to understand that we do get a referral fee if you choose to move forward with one of the loan options provided.

Debt consolidation loans can improve your credit score, get you on a fixed payment plans, and save you interest, but what happens if you’ve applied to many debt consolidation lenders and just can’t get approved?

Help! I Can’t Get A Debt Consolidation Loan and Can’t Afford My Debt

When you cannot get a loan, that is when individuals start to consider both debt consolidation programs and non profit credit counseling.

With debt consolidation programs (debt relief), a company would try to negotiate and settle your accounts when the accounts are behind. For example, a debt consolidation company would try to settle a $10,000 balance for $5,000, so you may save money.

I was the previous CEO of a debt relief company, and I believe it can be a good option for some people, but there are a number of cons companies may not make you aware of.

For example, your credit score could get really hurt, you could get sued for unpaid debt, and you could face tax consequences on forgiven debt.

Lets cover Patriot Funding’s history next.

Patriot Funding History

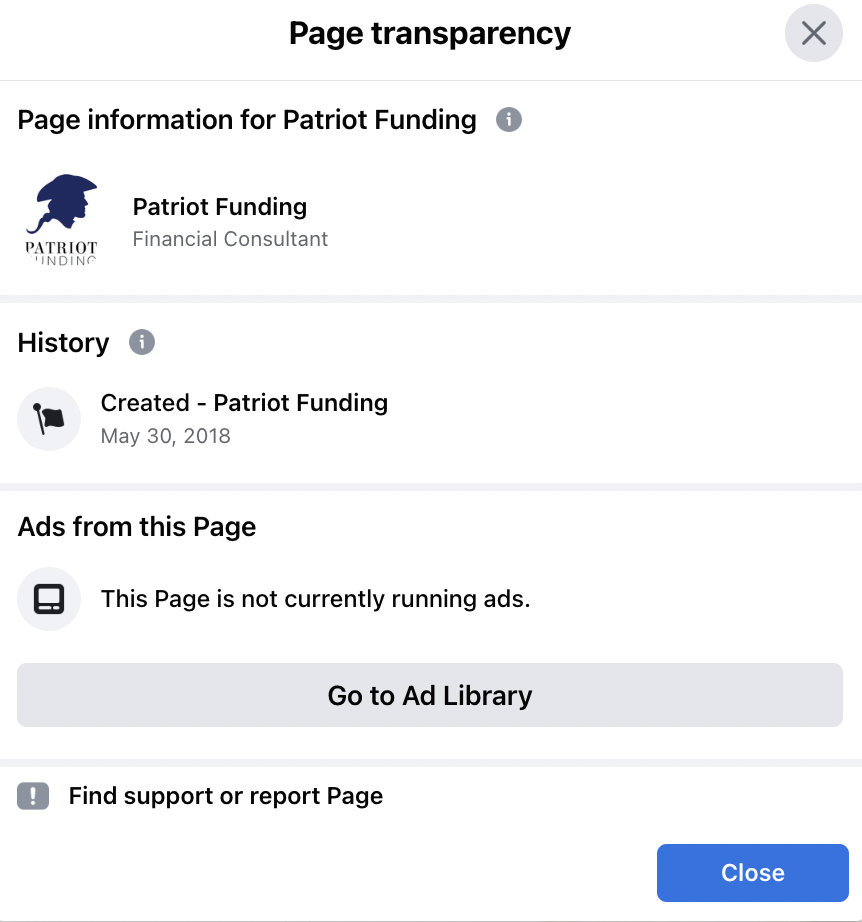

While I could not find much information on Patriot Funding’s history, I did notice that

Patriot Funding’s wayback machine actually dates back to 2018, which means that it seems like that the company may have been on a hiatus sending mailers as I have not seen anyone mention any Patriot Funding mailers recently.

On Facebook, Patriot Funding had an address of 2020 S. 3rd Street SE Building D, Suite 2F Mandan, ND 58554, which was interesting because I added that address into

Google street view and this is what I got in North Dakota

This deep dive search into Patriot Funding didn’t provide as much meat as I would have liked, but let’s look at how much debt consolidation programs may cost as it’s often not a percentage like 3.87%.

Not This Patriot Funding

When I was doing my research, I ran across this website that has the same name, but is a

different Patriot Funding. This website shows that the company is focused on such things as Bridge funding and equipment funding, not consumer debt consolidation loans.

As such, this was a different Patriot Funding.

How Much Do Companies Like Patriot Funding Cost?

At Ascend, we believe that debt consolidation programs (debt relief) may be a good option, but often in context in understanding all the costs and duration estimates of all your options. There are two types of firms you may work with, and the fees may be quite different.

- If you end up in a debt consolidation program with a non-law firm, you may pay generally between 15-25% of the enrolled debt amount, but the fees are not due until settlement has been reached and first payment has been made. So, if you have $10,000 in debt, you may pay between $1,500 and $2,500 in fees if you complete the program.

- If you work with a debt relief law firm, you may have to pay a retainer fees before settlements have been reached. This can be an important distinction to understand in case you have to cancel the program before any settlements have been reached. In a traditional debt consolidation program, you often pay fees after the first settlement has been reached, but attorney debt relief firms may charge retainer fees before settlement has been reached.

My Patriot Funding Reviews

One of the biggest things I couldn’t find for Patriot Funding is reviews. Let’s look first at my deep dive for Patriot Funding’s BBB page.

BBB

Let’s look at other Patriot Funding reviews.

Other Reviews

Unfortunately, I was not able to find any other review sites that cover Patriot Funding. For example, there was a

TrustPilot page for Patriot Finance, but it was obviously a different company because the link took me to a site covering Payday loans in Georgia.

Closing Thoughts

From my research, I realize I am not sure how Patriot Funding operates.

From my interaction with John about a similar mailer, it seems like this company may be a marketing service that refers out clients to other firms that practices debt settlement.

One question I have is whether Patriot Funding actually ever refers people to debt consolidation loan companies or if anyone gets a 3.87% interest rate. Or, potentially, it markets to people who can’t qualify for a loan, but does qualify for a debt consolidation program, which is 100% different.

Leave a Reply