You may have just gotten a quote from Freedom Debt Relief, but are wondering what are the fees you will be paying. For example, they may have said that the fees are included in the plan, but what percentage are you charged?

Suppose you have researched various debt relief options, and debt settlement is an option you are willing to c. In that case, you want to work with a popular company like Freedom Debt Relief. But how much do you know about the company and their fees?

Freedom Debt Relief is a popular debt settlement company which has helped thousands get out of debt. I know a lot about debt settlement companies, their services and fees since I was a previous CEO of a debt settlement company. In my experience, fees are an important factor to consider before signing up with any debt settlement company.

Our guide will focus on Freedom Debt Relief and the three main things you should know about the company’s fees. These are:

- How the company works

- How much Freedom Debt Relief charges customers in fees

- A comparison of Freedom Debt Relief charges with other debt settlement companies

How Does Freedom Debt Relief Work?

Freedom Debt Relief is a debt settlement company that helps its customers get rid of debt by negotiating with their creditors. They negotiate with creditors on behalf of customers to convince them to settle the debt for a lesser but lump sum amount.

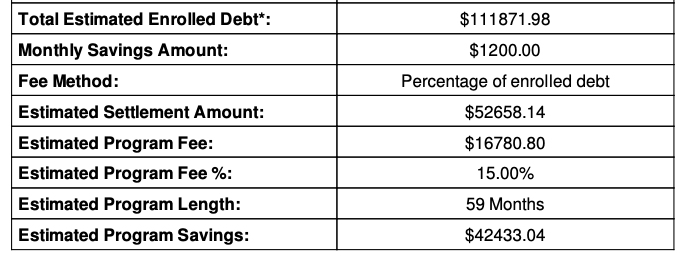

On average, Freedom Debt Relief charges a fee of 15% to 25% of the total enrolled debt. I believe the fee being charged is essential because, in this case, the variance between 15 and 25% is huge. It could be a difference worth thousands or tens of thousands of dollars.

Freedom Debt Relief may charge between 15 and 25%, but the difference in fees paid is very high.

The considerable variance could also lead to misunderstanding on the client side, which explains the negative reviews people share about working with Freedom Debt Relief. A competitor debt settlement company, Freedom Debt Relief, in their terms and conditions, states they charge fees approximately 21.5% of the total enrolled debt.

Therefore, I ask debtors to research the company’s fees before entering into a contract with them.

What are the Fees?

There are two ways you can know how much your fees will be. First, go through the Debt Negotiation Agreement and find the clause detailing the fees the company will charge. The Agreement is a document containing all details of the services that the company, Freedom Debt Relief, will offer you, the fees they will charge, the basis of the charge, and other relevant information on their services. It is lengthy and can be around 20 pages +-.

For example, many debt relief companies have a “Fees” section where information on the charges will be explained. The section could include how long the program will take and the percentage of payment the company will take as a service fee. If the company has yet to provide you with the agreement, you can ask a sales representative about the fee.

When I managed a debt relief/debt settlement firm, we explained how the fee worked on the initial calls and also put it plainly in the debt settlement client services agreement.

Common Fees Associated with Your Debt Settlement Program

Besides paying the debt settlement company, there are two hidden fees most people don’t know they pay for under the Freedom Debt Relief program but aren’t directly charged by the company:

Escrow Fee

When you are working with a debt settlement company, they will ask you to stop making payments to your creditors. Instead, they will ask you to channel the money to an escrow account. The company will provide you with the Escrow account details where you will be channeling the payments.

What they don’t get into details about is that there is a monthly Escrow fee which can cost between $9 and $15. The fee is usually charged before making the first settlement and is charged by the payment processor.

So, when you work with Freedom Debt Relief and sign up for the program, they will set up the account for you. The bank will house your deposits, and when the company finally settles your payment, they take out the money from the Escrow account, and the monthly escrow fees will be drawn then.

Legal Plan Fee

When the debt settlement company asks you to stop making payments to your creditors, some of them could sue you. So, they need a suitable ready legal plan which can cost between $25 and $100 monthly, depending on the creditor or debt collector.

I, however, believe this fee is unnecessary because It is the company’s role to assess your creditors and determine who could sue. They can avoid charging these legal plan fees if they prioritize negotiating with creditors likely to sue first to prevent lawsuits.

At What Point Does The Freedom Debt Relief Charge Their Fee?

When you sign up with any debt settlement company, including Freedom Debt Relief, you should not pay upfront until they have settled your account. Debt settlement companies only charge after successful negotiations with your creditor.

Previously, debt settlement companies would charge their feeds before settlement. However, in 2010, the FTC amended the Telemarketing Sales Rules, and since then, debt relief companies should not charge their customers before settlement for any debt.

For example, suppose you have outstanding debt from three creditors. If the company successfully negotiates with your first creditor, they will take their fee after settling your account with that creditor. Then, once they settle the second account, they will deduct their fee. They can charge their fees after each debt they help you settle, and not necessarily all accounts at a go.

How Much Do Other Debt Settlement Companies Charge?

Before settling on a particular debt settlement company, it is essential to compare the fees of different companies. At Ascend, we prioritize making the debt settlement fee as transparent as possible. So, we built a debt settlement fee calculator which you can use to compare fees different companies charge. Hopefully, the results can help you make informed decisions. We have also helped debtors consolidate their settlements with a more affordable program.

Conclusion

Freedom Debt Relief claims to charge a fee between 15 and 25% of your total enrolled debt. However, this is vague, and there is a great variance which translates to some thousands. We have covered everything you should know about Freedom Debt Relief and its charges. Always research, compare the fees, and consider alternative debt relief options before signing up with a company.

Leave a Reply